Sopheon plc, the international provider of software and services for Enterprise Innovation Management solutions, is pleased to announce its results for the year ended 31 December 2021, together with an outlook for the current year.

Financial Highlights:

- Revenue of $34.4m, ahead of market expectations in the face of continued COVID challenges, whilst embedding the SaaS transition (2020: $30.0m)

- ARR 1 rose from $18.0m at the start of 2021 to $20.7m at the end of the year

- Full year 2022 revenue visibility 2 stands at $25.1m (last year at this time: $24.5m)

- Gross retention at 95% (2020: 91.5%)

- Adjusted EBITDA 3 of $6.2m (2020: $5.9m) also ahead of market expectations

- Profit before tax of $1.2m (2020: $1.7m) affected by higher amortization and share based payments

- Net cash of $24.2m (2020: $21.7m) and the Group has no debt

- Dividend to be maintained at 3.25p per share (2020: 3.25p)

Operational Highlights

- 10 new customer wins of which 9 were SaaS, driving rising quality of earnings and demonstrating the successful shift to a SaaS model. Looking forward, the license pipeline for new customers approaching 90% SaaS. Another six existing clients (2020: 4) were converted to SaaS as part of the Group’s SaaS Uplift program.

- Acceleration of product investment resulted in a higher delivery pace for enterprise Accolade releases. In parallel, investment in cloud-native solutions, with a first application targeted at expanding the Accolade user community. Initial application to launch mid-2022.

- We stepped up marketing programs and investment significantly in 2021 to extend market reach, prospect engagement and ultimately lead generation. This expanded go-to-market strategy is geared to increase new customer acquisition, reducing reliance on large customers who require particular capabilities, and to address a broader target market in order to improve scalability and predictability.

- The acquisition of ROI Blueprints business added deep project management capability eliminating the need for customer purchase and integration of third-party tools in that area.

- Greg Coticchia was appointed CEO during the year, also introducing new leadership in sales, marketing and product areas.

Andy Michuda, Chairman, commented: “2021 was a year of new leadership, new processes, new programs, and extensive organizational change, together with solid financial outcomes and an initial acquisition. With the initiation of change behind us and the organizational structure and leadership in place, 2022 is very much focused on accelerating and operationalizing the effectiveness of this change. I believe that the future is bright for Sopheon and for Sopheon shareholders.”

For further information contact:

| Andy Michuda (Chairman) Arif Karimjee (CFO) |

Sopheon plc | + 44 (0) 1276 919 560 |

| Carl Holmes/ Edward Whiley (Corporate Finance) Alice Lane/Sunila de Silva (ECM) |

finnCap Ltd | + 44 (0) 20 7220 0500 |

About Sopheon

Sopheon (LSE: SPE) partners with customers to provide complete enterprise innovation management solutions including software, expertise, and best practices, that enable them to achieve exceptional long-term revenue growth and profitability. Sopheon’s Accolade® solution provides unique, fully integrated coverage for the entire innovation management and new product development lifecycle, including strategic innovation planning, roadmapping, idea and concept development, process and project management, portfolio management and resource planning. Sopheon’s solutions have been implemented by over 250 customers with over 60,000 users in over 50 countries. Sopheon is listed on AIM, operated by the London Stock Exchange.

1ARR is annual recurring revenue at a point in time, being the value of recurring SaaS, maintenance and hosting revenue streams normalized to a one-year period.

2Revenue visibility comprises revenue expected from (i) closed license orders, including those which are contracted but conditional on acceptance decisions scheduled later in the year; (ii) contracted services business delivered or expected to be delivered in the year; and (iii) recurring maintenance, hosting, SaaS and rental streams. The visibility calculation does not include revenues from new sales opportunities expected to close during the remainder of the year.

3Adjusted EBITDA is defined and reconciled in Note 5 to this report

Stage-Gate® is a registered trademark of Stage Gate Inc. – see www.stage-gate.com

Sopheon® and Accolade® are registered trademarks of Sopheon plc.

Chairman's Statement

Our 2021 performance was gratifying both for the strategic progress we made and for exceeding our financial market expectations despite such an uncertain economic environment. It is very pleasing to report revenue growth of 14.6% at $34.4m (2020: $30m) and adjusted EBITDA of $6.2m (2020: $5.9m) along with 15% growth in Annual Recurring Revenue (“ARR”) to $20.7m at the end of the year (2020: $18.0m). Cash grew to $24.2m (2020: $21.7m). In addition to our financial results, 2021 was a year of unusually high activity and change for Sopheon. Our new CEO and newly added executive team wasted no time in moving forward with the company’s growth strategy and agenda. As detailed in recent years, we have continued pursuing our investment path for growth.

At the time of this report, revenue visibility1 stands at $25.1m (2020: $24.5m). The consulting services element of visibility is lower than the year before, due to the nature of deals signed in recent months. As previously noted, ARR has grown strongly. We are on a journey of transition from a traditional perpetual software license business to a higher-quality recurring revenue business, with the goal of delivering more predictable and reliable growth over the medium term and increased value to our shareholders. In the shorter term, this transition is naturally weighing on profits as we accelerate go-to-market investment while simultaneously shifting software revenue recognition from an up-front to a rateable model.

As announced through the year, along with Greg taking on the CEO role, we have also strengthened our leadership team with appointments in key marketing, sales, and product areas. The team has introduced and driven three key programs to support our strategic direction. As noted above, a core goal is to increase ARR; as a percentage of revenue, it now stands at 60 percent of trailing annual revenue compared to 53 percent when we started this journey in 2019. Two initiatives are driving this key program – first, moving our perpetual customer base to a Software-as-a-Service (“SaaS”) through a targeted cloud uplift program; and second, we have completed the transition of our new sales go to market approach to a SaaS first model. By value, almost 90 percent of our pipeline for new software opportunities is for SaaS business.

The second key program, equally important to our growth strategy is the increased investment being made in product, with the expectation to generate higher rates of growth. Last year, our development organization embraced fundamental directional, and process change with expectations to step up the pace of product releases. We are also moving towards a multi-product future, expanding beyond our enterprise Accolade solution. We have ambitious plans in the product investment area which will take patience and time. Our goals here are to:

- Continue to advance our flagship Accolade enterprise solution and maintain our market leadership. During 2021, three new versions were released, and we plan an ongoing pace of four per year going forward.

- Introduce new cloud-based applications providing value to individual and workgroup users in the corporate ecosystem, alongside Accolade’s enterprise value proposition. Initial market introduction of the first application is planned for mid-2022. These applications are intended to be stand-alone solutions that solve individual productivity needs in addition to creating future upsell opportunities for Accolade.

- Rapidly integrate acquired products to support extension sales generated from acquisitions. This journey is very active with the ROI Blueprints (“ROIB”) acquisition completed in December 2021, and already playing a material role with both existing and new customer opportunities.

The third key program is our investment in go-to-market strategies and programs, with the expectation to expand our market reach and generate higher growth rates. We have stepped up marketing programs significantly in 2021, tracking metrics for market reach, prospect engagement and ultimately lead generation. We expect to see continued activity and results in the coming year. We are also adjusting our strategy to reduce our reliance on a smaller number of large customers and thereby improve scalability and predictability.

We have previously shared our intention to engage in M&A, so it was very pleasing to close our ROIB acquisition last December. Integration is under way with focus on achieving key time-based milestones. We are actively researching additional acquisition opportunities to improve time-to-realization for our transformation and growth ambitions.

Outlook

2021 was a year of new leadership, new processes, new programs, and extensive organizational change, together with solid financial outcomes and an initial acquisition.

With the initiation of change behind us and the organizational structure and leadership in place, 2022 is very much focused on accelerating and operationalizing the effectiveness of this change. I believe that the future is bright for Sopheon and for Sopheon shareholders.

CEO Review

Both externally and internally, 2021 was a year of change for Sopheon. While I joined Sopheon in late 2020, it was an honor to succeed Andy Michuda as CEO in early 2021 and lead Sopheon’s continued success through these changes. At the time, the coronavirus pandemic was continuing to affect all sectors of the economy. Despite the challenges of a global pandemic and its impact on every business worldwide and on their related investments in their businesses in many areas, Sopheon continued to gain net new customers and expand our relationships with existing customers. Innovation expenditures, even during times of crisis, proved to be resilient. Market spending in the innovation management space was estimated to be over $1.026B and growing at a CAGR of 16.9% (Markets and Markets, Innovation Management Market with COVID-19 Impact Analysis Global Forecast to 2026, September 2021).

We started 2021 with several key objectives:

- to increase the pace with which we deliver new and unique value to our customers in both product and services;

- to accelerate our transition to a SaaS model for our flagship product, Accolade, while steadily extending the company’s reach towards a more user-centric product, underpinned by cloud-native, multitenant delivery; and

- finally, to identify and integrate capabilities through acquired intellectual property.

We achieved all these goals while achieving our financial goals. How?

- Over the year, we continued the movement of customers to a cloud-hosted solution; all of our new customers were SaaS or hosted, and an additional six existing on-premise customers were migrated, bringing us to 53% of our customers in the cloud, and while also investing in a true cloud-native version of our product.

- We increased our scheduled development pace to four times a year, delivering three releases of our flagship product Accolade on this new pace during 2021, along with 10 point releases and more than a dozen new features. These new capabilities increase value to our customers and allow us to be more competitive in gaining new customers.

- We defined a clear market strategy based on knowledge from customers, prospects, sales, and industry analysts, and identified companies for licensing, partnering, and acquisition. As a result, we accomplished our first acquisition in many years, ROI Blueprints, and initiated integration immediately.

Market Trends

Sopheon is a company that continues to transform to meet the promise of the market it serves: innovation. That has been our journey for the past year. We continue to understand that, as a provider of innovation solutions, we must also innovate and even transform our business while building on our foundation of success. To this end, we have defined and begun to execute on our updated three-year strategy for Sopheon. This strategy is informed by our customers, the innovation market, and our people.

Some of the most valuable ‘assets’ we have are the foundation of our well-recognized, brand-name customers across many industries; our proven product; our ability to deliver our innovation and new product development expertise to make customers successful; and the go-to-market operations that create awareness and relationships with customers. Moreover, we have a wonderful team of people. At our core, all ‘Sopheonites’ (as we call ourselves) bring this strategy together and drive towards the goals we set. Sopheon has been and will continue to be a proven and trusted partner for innovation.

In a poll by MarketsandMarkets, a leading global market research and consulting company, Sopheon was ranked number one in the innovation management marketplace. It is tough being number one in any marketplace, but we are, and we are beating companies that are larger than us. With that said, we realize the new norm is "constant change," and to continue our position of leadership and market relevance; we must continue to change. We believe the best time to examine and adjust an organization's strategy is from a position of strength. Here are the market drivers we are responding to as we transform our business:

- How customers want to buy has changed. Business to Business (B2B) buyers are self-educating about products that interest them and demanding self-service where they experience the product with no assistance from the company. They do not want to be informed from outbound marketing and set up an appointment with a salesperson to get educated. At a minimum, it's happening much later in the sales process.

- According to a survey by the Corporate Executive Board, “On average – and with little variation among industries – customers will contact a sales rep when they independently complete about 57 percent of the purchasing decision process.”

- The person making the decision about what to buy is changing. Decision making – even enterprise decision making – is moving rapidly from the executive buyer to the ‘end user’ as an initial purchasing step. The end-users want to get their hands on the product immediately, either through a free trial or some type of “freemium” offering – the product itself becomes the primary driver of customer acquisition (“product led growth” or “PLG”).

- Since 2012, according to the OpenView 2020 SaaS Product Benchmarks Report, the number of US public software companies operating a PLG model grew from one to 27.

- Customers want to purchase for very specific capabilities that solve more immediate problems. Customers care about the quality and velocity with which you deliver useful product features and experiences through digital means. The better you are at this, the more satisfied your customers will be.

- In the article “The Death of Big Software” while tightly bundled, standardized software made some sense back in the day, it makes little or no sense in the era of digital transformationwhere disruptive business processes and business models are seen as necessary paths to competitiveness.

- And specifically in our market of innovation, two major trends are happening:

- Innovation processes are changing. We have traditionally focused on automating the Stage-Gate® process as a core competency for our customers. However, we recognize that there is a bureaucracy governing Stage-Gate processes that can impede speed and agility. Companies –even our traditional physical product customers in consumer-packaged goods and chemicals—have discovered that newer ‘Agile’ methods lead to improved project speed, decision-making, and communication. Stage-Gate has become less prominent as a process to automate because speed is more important today. New digital tools have sped up innovation, the lessons of Stage-Gate have been learned, and companies are now looking to make their innovation process faster and less rigid.

- Digital/ Software tools are coming into our market. All companies are becoming software companies. In 2011, Marc Andreessen famously wrote a prescient claim that “software is eating the world.” His prediction was that software companies would disrupt traditional industries, and since then, we've seen industries transform, and companies fold in response to Amazon, Netflix, Airbnb, and more. We are seeing early-stage companies with point products in product development coming into our markets and appearing at our customers as they hire software developers to work in their businesses.

As the market leader, Sopheon recognizes these trends and is responding. We see many opportunities for us in these changes to the innovation market.

Our Response

So how do we respond to these? Sopheon has put together the following three-point strategy, supported by five “action” themes. Our three-point strategy to meet the market needs is:

- SaaS/Annual Recurring Revenue Focus

The SaaS model is an approach in which a business makes profits by offering cloud-based capabilities to clients. Customers can access SaaS applications over an internet network remotely, from any device and place, which can be more advantageous than traditional software business models. In these situations, the software provider is responsible for building, installing, configuring, and updating the application. When using the SaaS model, companies provide cloud applications to customers on a subscription payment basis. Organizations follow a SaaS framework to reduce costs, increase accessibility, improve customer satisfaction, and expand their financial success. Sopheon has transitioned 10 of its on-premise customers to the SaaS model, and we have also completed the shift to go-to-market with Accolade foremost as a SaaS service for new customers. Combined with a high gross retention rate of 95 percent and a high Net Promoter Score (NPS) of 45, we are already starting to see the benefits from the SaaS business model of greater financial stability, high scalability, and predictable revenue leading to better quality of earnings. This transition will continue in 2022.

- Filling out the product roadmap

Last year, our development organization embraced fundamental directional and process change with expectations to step up the pace of product releases while also moving the company towards a multi-product future, reducing our reliance on Accolade alone. We have ambitious plans in the product investment area which will take patience and time. Clearly, our flagship Accolade enterprise solution underpins our business, and we will continue to invest and extend it, maintaining our market leadership. During 2021, three new versions of Accolade were released, and we plan an ongoing pace of four releases per year going forward.

In parallel, we will introduce new cloud-based applications providing value to individual and workgroup users in the corporate ecosystem, alongside Accolade’s enterprise value proposition. Initial market introduction of the first application is planned for mid-2022. Our gateway to the PLG approach, these applications are intended to drive lead generation for Accolade, as well as being stand-alone solutions that solve individual productivity needs. Integration with Accolade itself will be an essential element of these applications.

In addition, we have defined areas where licensing, partnering, or acquisition can strengthen our market position, drive competitive differentiation, reduce customer acquisition costs, increase retention and customer lifetime value, and create the opportunity for more revenue per customer. This past year we improved our competitive position by acquiring ROI Blueprints. ROI Blueprints is a SaaS project and portfolio management product enabling customers to manage project schedules, costs, resources, risks, and deliveries easily and effectively. This has long been a capability that customers have asked for and a capability we would formerly have to deliver through third-party integration. We expect that ROIB will add revenue and increase our overall competitiveness. Finally, it also fits well into our plans for a future end-user-focused offering in this space.

- Pursuing new go-to-market strategies to expand market reach

Sopheon has a well-defined marketing strategy for our industry-leading Accolade solution. We have grown by focusing on key verticals such as Food & Beverage, Chemical, Aerospace & Defense, and Industrial Manufacturing. Servicing these markets will continue to be a strength moving forward. But we also see an opportunity to grow beyond these verticals, as the market for innovation is growing at even a faster rate than we have historically performed and faster than even market growth rates in innovation.

We have stepped up our investment in marketing communications, where we have historically been more conservative, to ensure we are creating improved results in reach, engagement and leads required to continue to grow our customer base. Also, these marketing activities will lay the foundation for connections with the new individual and work group buyer of our software with our cloud-native PLG offering, in turn creating upsell opportunities for our Accolade enterprise solution. Finally, we are also establishing new business and technology partnerships. With more and better partnerships, we can expand our capabilities, benefitting customers, differentiating from competitors, both without taking on the full costs.

Throughout its history, Sopheon has tackled the large innovation challenges of some of the world’s largest companies. This experience has allowed us to prosper and gain many remarkable ‘blue chip’ customers. While we focused on meeting many of their highly unique needs, we sacrificed building a product that could meet a larger market need. Historically, this was not unusual in the enterprise software market; many Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) products faced the same challenges.

Given the stated Corporate Enterprise industry trends and shifts discussed above, we find ourselves in a unique opportunity to introduce a product that not only continues to meet the Enterprise requirements but also addresses the new market requirements.

How We Execute our Plans

As we look to transform Sopheon and execute this strategy, we have created five themes to support the activity that needs to take place for us to succeed. For Sopheonites, these themes are not just words on paper; they have been turned into specific Objectives and Key Results (OKRs) – a collaborative goal-setting methodology used by teams and individuals to set challenging, ambitious goals with measurable results – by each department leader with specific Key Performance Indicators (KPIs) that will allow us to focus on achieving our goals.

They are:

GROWTH: Repeatable, scalable, profitable growth through increased net new customers and strong customer retention.

MORE: Broadening of product offerings and market solutions, company/technology acquisition, and delivering differentiated value.

SPEED: Faster time-to-value for our customers.

VISIBILITY: Greater awareness of Sopheon and expressed interest in our products and services

PEOPLE: Attract, retain, and grow our employees to best accomplish our company’s goals.

A deeper look at each one of these is set out in the annual report.

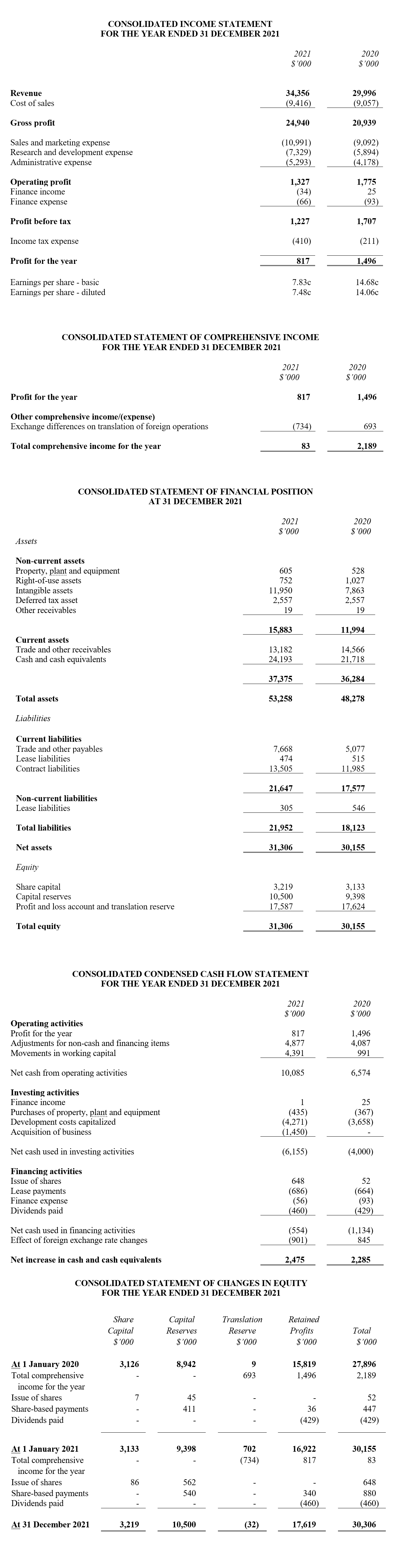

Financial Review

Overall revenue grew strongly to $34.4m up from $30.0m the year before. This comprises $24.0m of software revenue (2020: $20.3m) showing growth of 18 percent, and $10.4m of consulting services (2020: $9.7m) representing growth of 7 percent. Behind this headline performance, ARR grew to $20.7m, an increase of 15 percent compared to the prior year at $18.0m. This key aspect of our migration continues to show good movement and is discussed in more detail below.

Trading Performance

Total license order volume (including SaaS deals) grew substantially to 72 (10 new) license transactions compared to 43 (10 new) the year before; and moreover 39 were SaaS compared to 22 the year before. A higher volume was offset by lower average deal value – we saw fewer million dollar deals signed in 2021, but we are reassured that overall a higher volume of smaller orders is good evidence of market traction. SaaS naturally lends itself to smaller initial orders followed by the promise of future expansion as reflected in the substantially higher volume of extension orders. The combination of higher volume but lower deal value led to total TCV coming in modestly above 2020 levels. Within that, the TCV of SaaS business rose to $7.3m (2020: $6.6m). Supported by our ARR transition, revenue visibility for the year now stands at $25.1m compared to $24.5m at this time a year ago.

SaaS & ARR

As Andy and Greg have noted above, we continued to make progress on our two core steps to move the business to SaaS first introduced in 2020. For new customers, the sales team now only offers SaaS unless, by exception, the customer makes an explicit requirement for a perpetual license. As noted elsewhere, the make-up of the pipeline has shifted. At the end of 2020, approximately 75 percent of our new license opportunity by value was SaaS related. Today, this is almost 90 percent. For existing perpetual customers, in particular those that do not host with Sopheon, we have developed a “Cloud Lift” program to encourage them to upgrade their perpetual license to a SaaS license, delivering good return on investment by taking on hosting and certain managed services and we have implemented this change for 10 customers so far. This is being further enhanced with new pricing models designed to offer additional inducements for customers to switch to SaaS. In addition to the four perpetual customers that took advantage of Cloud Lift during 2020, we added a further six in 2021. We believe this program will continue to gain momentum as we progress through our transition and continue to improve the value of our cloud offering. Furthermore, approximately 50% of the license transactions signed during 2021 were for SaaS contracts, and the value of SaaS bookings was more than double that of perpetual contracts.

As highlighted by the metrics above, the conversion of Sopheon’s revenue model to SaaS continued during the year while delivering overall growth in revenues, highly unusual while going through this revenue transition. This was also supported by a solid improvement in gross retention which returned to historic levels of 95 percent (2020: 91.5 percent). Our customer base continues to report high satisfaction levels, with our net promoter (“NPS”) surveys recording an all-time high NPS score of 45 in 2021. A score of 45 is considered excellent for B2B enterprise software. We continue to ensure that our customers are on new releases, with almost 80 percent of them on Accolade versions 13 and 14, the current supported releases.

Seasonality and Geography

The sensitivity of revenue to calendarization has started to come down, which is something we expected to happen as our recurring revenue began to rise more steeply. The second half of the year accounted for 52 percent of revenues (2020: 54 percent and 2019: 55 percent). Unlike previous years, we also saw less seasonality in the booking experience; while overall bookings were higher in 2021, whereas 2020 saw 44 percent of TCV signed in the final quarter, in 2021 the final quarter represented 20 percent of the total.

Revenues to customers in our core markets of North America and Europe were 60 percent and 31 percent of total respectively (2020: 61% and 32%). Following several signings in the Asia-Pacific region in 2020 and also in 2021, revenues outside our core regions rose by $1m to make up the remaining 9 percent (2020: 7%). Our activities in the Pacific region continue to be managed through partners while the broader Americas, Europe and Middle East markets are addressed by our direct sales teams.

Gross Margin

Gross margin was 72.6 percent, compared to 69.8 percent in 2020. This remains well within the historical range. Gross margin is calculated after deducting the cost of our consulting organization – both payroll and subcontracted; costs and charges associated with our hosting activities, some license royalties due to OEM partners and costs and credits relating to certain indirect taxes. The change in margin last year was driven largely by the dynamics of our services organization. Although total consulting revenue rose in absolute terms, it both fell as a percentage of total revenues and also improved its own gross margin largely through higher staff utilization and better hourly recovery rates. Headcount in this area actually fell compared to 2020.

Research and Development Expenditure

Overall expenditure in product development in 2021 increased by approximately $1.7m to $8.6m. These amounts can be compared to the headline research and development reported in the income statement showing an increase from $5.9m to $7.3m; the differences are due to the effects of capitalization and amortization of development costs. Headcount in this area went up by four on a yearly average basis, with significant strengthening in product management in particular. In addition, we added eight offshore FTEs in the second half. This continued expansion of resources supports the multi-product strategy mentioned in the Chairman’s statement. We are maintaining investment in our core enterprise Accolade solution, while also developing cloud-native applications that will bring multiple benefits in the short and medium term. Looking ahead, we will add investment in the ROIB solution. Greg explains the strategic ambition that underpins these multiple product tracks in his report. As we note later, we offset delays in hiring staff through the addition of greater subcontracting resources.

Overall, the amount of 2021 research and development expenditure that met the criteria of IAS 38 for capitalization was $4.3m (2020: $3.7m) offset by amortization charges of $3.0m (2020: $2.7m). The higher capitalization rate reflects the greater resources referred to above; the consequent impact on amortization will come through over time as the products are released. Capitalized costs in 2021 are largely attributable to the group’s investment in the Accolade 13.3, 14.0, 14.1 and 14.2 versions, as well as our foundation cloud-native platform. The first three releases were issued during 2021; Accolade 14.2 in early 2022, and our first cloud native application is expected in 2022. This will initially be marketed on a “freemium” model whereby users can download the application at no charge with the future option to purchase higher subscription tiers to access greater functionality.

Other Operating Costs

Payroll costs continue to represent over 80 percent of our cost base. Sopheon has a relatively mature and highly qualified blend of staff, reflecting the professional and intellectual demands of our chosen market. In 2020, we froze our previously ambitious hiring plans due to the onset of the pandemic. In 2021, we reintroduced recruitment targets but were once again somewhat thwarted, this time by the incidence of higher staff churn as the impact of the recovery and the “great resignation” took hold. Salary pressures have also been marked during 2021, consistent with the rest of the technology sector. Accordingly, we ended last year with 167 staff, compared to 169 at the end of 2020. Average headcount for the year was also 167 (2020: 164). Several recruits during 2020 were senior including several new members of the management team. Excluding variable pay, staff costs as reported in Note 7 of the financial statements increased by approximately $1.25m due to all these factors. A further $0.25m was due to currency effects. Variable pay also increased, reflecting higher commissions and bonuses tied to the stronger financial performance during the year. We have modified the corporate bonus scheme, applicable to all non-sales staff in the company, adding a material element of ARR goal to our historical focus on EBITDA. The bonus is paid in the following year. In parallel, subcontracting costs rose by approximately $0.4m. This is primarily linked to increases in our offshore team working in India, which rose by 8 for a total of 18 FTEs during the second half of 2021. The offshoring is achieved through an outsourcing firm and supports both consulting and development efforts. Non-payroll costs, which fell in 2020, increased by approximately $0.9m before exchange, interest, tax and depreciation. The main components of the increase were expanded marketing program costs; staff training and infrastructure costs associated with our transition plans; and deal related expenses in connection with the acquisition of ROIB. These were offset to some degree by very low travel costs.

Taking a functional view, specific comments regarding consulting operations and research and development costs are noted above. Overall costs in the sales and marketing area increased by approximately $1.9m including variable compensation. This mainly reflects the higher variable component, addition of new leadership, and the significantly higher investment in marketing programs referenced earlier in this report. Administration costs – which include infrastructure costs - have risen by approximately $1.1m. This area includes all other overheads, office costs, regulatory and compliance costs, and depreciation, as well as the full impact of the notional charge for share option grants, which is allocated entirely to this caption. Roughly half the increase came from higher share option costs as well as exchange losses arising on stronger sterling; the balance reflecting additional resources in training and IT in line with our transition investments, as well acquisition related expenses.

With regard to foreign exchange, historically the group has aimed to incorporate a natural hedge through broadly matching revenues and costs within common currency entities, reducing the need for active currency management. In recent years this has become somewhat less balanced as our cost base has become increasingly dollar driven, while revenues remain roughly two thirds dollar and one third euro or sterling. This has led to a build-up of Euro balances. Following the recent reversal of Euro strength, we are now gradually shifting this into dollars.

Results and Corporate Tax

Adjusted EBITDA (Earnings before Interest, Tax, Depreciation, Amortization and Share based payments) is a key indicator of the underlying performance of our business, commonly used in the technology sector. It is also a key metric for management and the financial analyst community. This measure is further defined and reconciled to profit before tax in Note 5. The combined effect of the revenue and cost performance discussed above has resulted in Sopheon’s Adjusted EBITDA performance for 2021 rising to $6.2m, from $5.9m in 2020. Due mainly to the incidence of higher share based payment charges, as well as higher amortization, profit before tax reduced to $1.2m (2020: $1.7m).

The tax charge of $0.4m (2020: $0.2m) reported in the income statement comprises two main elements. Although Sopheon benefits from accumulated tax losses in several jurisdictions including at the US federal level, this is not universal, and accordingly a current tax charges of approximately $0.2m each was incurred in Germany and for state taxes in the US. In addition, a $2.6m deferred tax asset is recognized at both 31 December 2020 and 2021, of a total potential asset of $11.7m (2020: $11.1m).

Altogether this leads to a profit after tax of $0.8m (2020: $1.5m). This has also resulted in profit per ordinary share on a fully diluted basis of 7.47 cents (2020: 14.06 cents).

Dividend

The Board is pleased to maintain Sopheon’s dividend at 3.25 pence per share for the year ended 31 December 2021 (2020: 3.25p). We believe this level strikes the right balance between a business going through a complex SaaS transition, while still delivering positive revenue growth, cash generation and balance sheet strength. Subject to approval by the Company’s shareholders at the annual general meeting scheduled for 9 June 2022, the dividend will be paid on 8 July 2022 with a record date of 10 June 2022.

Facilities and Assets

We continued to be cash generative during 2021 in spite of the tough environment, with cash rising to $24.2m (2020: $21.7m) as detailed below. This provides a strong platform for growth as well as M&A. Furthermore, our relationship with Silicon Valley Bank remains strong, with potential established for funding arrangements in connection with corporate activity if required.

Intangible assets stood at $11.9m (2020: $7.9m) at the end of the year. This includes (i) $8.1m being the net book value of capitalized research and development (2020: $6.9m) (ii) acquired technology and intellectual property rights of $2.3m arising on the acquisition of ROIB; and (iii) an additional $1.6m (2020: $1.0m) being goodwill arising on acquisitions, including $0.6m for ROIB arising in 2021.

As stated above in our discussion of research and development costs, capitalization and amortization were broadly in balance for a number of years; however, recently capitalization has accelerated, and amortization has yet to catch up, as development resources have expanded over the last few years. Our spend on tangible fixed assets was held to $0.4m last year (2020: $0.4m) whereas depreciation was approximately $0.3m (2020: $0.4m), resulting in net book value rising to $0.6m at the end of the year (2020: $0.5m).

With respect to the acquisition of ROIB, as detailed in Note 14 we have estimated approximately 88 percent of the contingent consideration will become payable during the earnout period, resulting in a total net acquisition cost of $2.8m. Of this, $2.3m has been allocated to technology and intellectual property rights, with the balance being treated as goodwill.

As described in Note 1, IFRS 16 requires lessees to recognize a lease liability that reflects future lease payments and a "right-of-use asset" in all lease contracts within scope, with no distinction between financing and operating leases. This has resulted in net book value of right-of-use assets of $0.8m (2020: $1.0m) and corresponding lease liabilities of $0.8m (2020: $1.1m) at 31 December 2021. Notional amortization and interest charges in connection with the above recognized in the income statement were approximately $0.7m (2020: $0.7m).

Consolidated net assets at the end of the year stood at $31.3m (2020: $30.2m), an increase of $2.1m and including net current assets of $15.7m (2020: $18.7m). Within the net current asset position, net cash at 31 December 2021 amounted to $24.2m (2020: $21.7m). Approximately $5.6m was held in US Dollars, $15.2m in Euros and $3.4m in Sterling. The group has no debt (excluding notional debt from the adoption of IFRS 16).

1. Basis of Preparation

The financial information set out in this document does not constitute the Company's statutory accounts for the years ended 31 December 2020 or 2021. Statutory accounts for the year ended 31 December 2021, which were approved by the directors on 23 March 2022, have been reported on by the Independent Auditors. The Independent Auditors' Reports on the Annual Report and Financial Statements for each of 2020 and 2021 were unqualified, did not draw attention to any matters by way of emphasis, and did not contain a statement under 498(2) or 498(3) of the Companies Act 2006.

The Annual Report (including the statutory financial statements) for the year ended 31 December 2020 have been filed with the Registrar of Companies. The Annual Report (including the statutory financial statements for the year ended 31 December 2021 will be delivered to the Registrar in due course, and are available from the Company's registered office at Dorna House One, Guildford Road, West End, Surrey GU24 9PW and are available today from the Company's website at www.sopheon.com/financial-reports/.

The financial information set out in these results has been prepared using the recognition and measurement principles of UK adopted International Accounting Standards in accordance with the requirements of the Companies Act 2006. The accounting policies adopted in these results have been consistently applied to all the years presented and are consistent with the policies used in the preparation of the financial statements for the year ended 31 December 2020, except for those that relate to new standards and interpretations effective for the first time for periods beginning on (or after) 1 January 2021. There are deemed to be no new standards, amendments and interpretations to existing standards, which have been adopted by the Group that have had a material impact on the financial statements.

Approximately two-thirds of the Group’s revenue and operating costs are denominated in US Dollars and accordingly the Group’s financial statements have been presented in US Dollars.

2. Going Concern

The consolidated financial statements have been prepared on a going concern basis. The directors have at the time of approving the financial statements, a reasonable expectation that the company has adequate resources to continue in operational existence for the foreseeable future. The COVID-19 pandemic and the war in Ukraine have so far had limited impact on our business and the board believes that the business is able to navigate through the continued challenges of these events due to the strength of its customer proposition and business partnerships, statement of financial position and the net cash position of the Group.

The current economic and geopolitical conditions continue to create uncertainty, particularly over (a) the level of customer and potential customer engagement; and (b) the level of new sales to new customers. The pandemic has had a widespread impact economically, with potential for causing delays in contract negotiations and/or cancelling of anticipated sales and an uncertainty over cash collection from certain customers. As a consequence, the Group has carried out detailed forecast stress testing in order to consider how much forecasts have to reduce by in order to cause cash constraints, and also to consider the likelihood of this scenario occurring. This assessment has also included the Group’s actual cash holdings as of the date of the approval of these financial statements and financing alternatives available to the Group. Overall, these cash-flow forecasts, which cover a period of at least 12 months from the date of approval of the financial statements, foresee that the Group will be able to operate within its existing facilities. Nevertheless, there is a risk that the Group will be impacted more than expected by reductions in customer confidence. If sales and settlement of existing debts are not in line with cash flow forecasts, the directors have the ability to identify cost savings if necessary, to help mitigate the impact on cash outflows.

Having assessed the principal risks and the other matters discussed in connection with the going concern statement, the directors have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future. For these reasons, they continue to adopt the going concern basis of accounting in preparing the financial information.

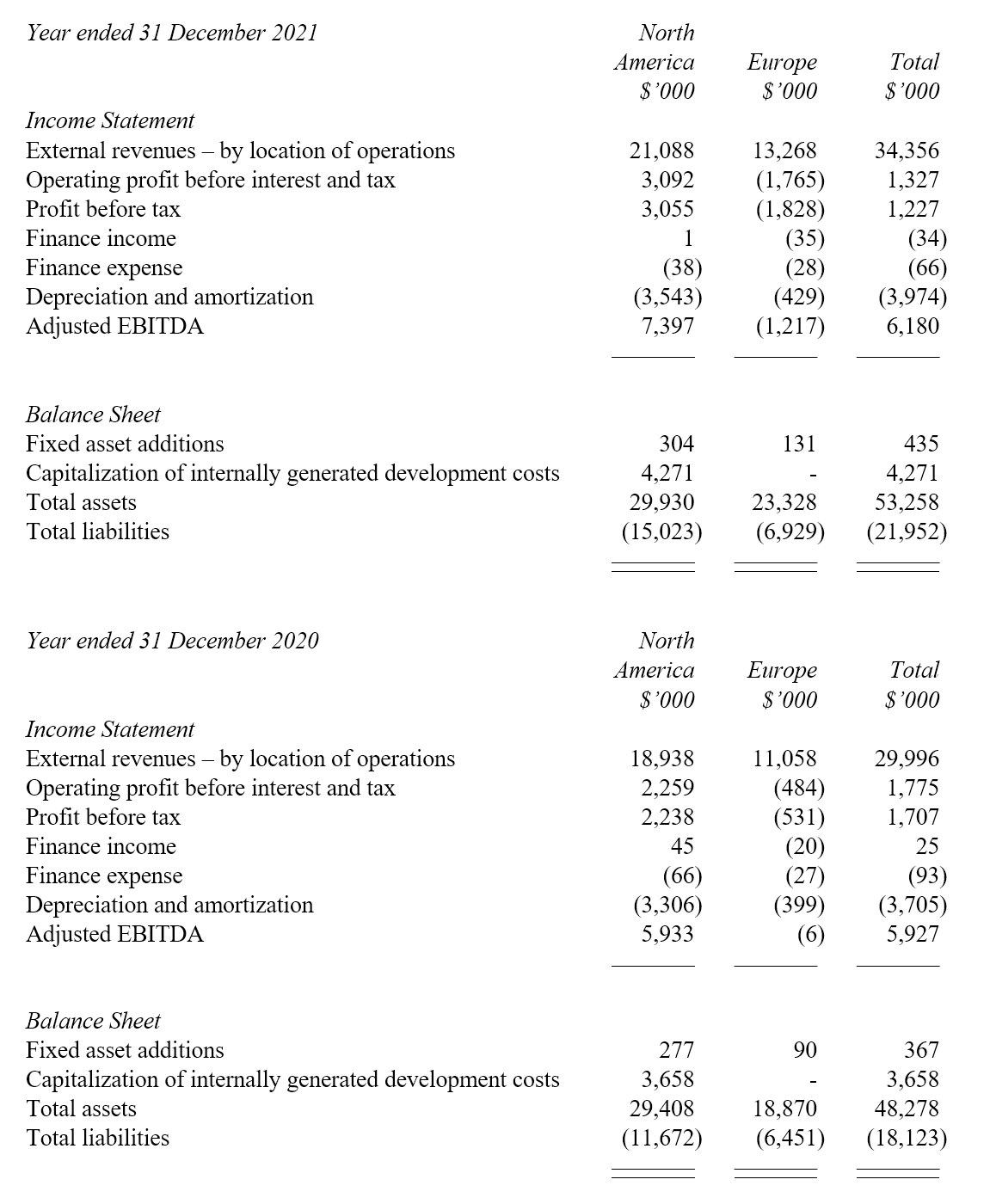

3. Segmental Analysis

All of the Group’s revenue in respect of the years ended 31 December 2021 and 2020 derived from the design, development and marketing of software products with associated implementation and consultancy services, as more particularly described in the Chairman’s statement. The business is seen as one cash generating unit and operates as a single operating segment. For management purposes, the Group is organized geographically across two principal territories, North America and Europe. Information relating to this geographical split is outlined below.

The information in the following table relates to external revenues location of operations. Inter-segment revenues are priced on an arm’s length basis.

Revenues attributable to customers in North America in 2021 amounted to $20,434,000 (2020: $18,332,000). Revenue attributable to customers in the rest of the world amounted to $13,922,000 (2020: $11,664,000) of which $10,765,000 (2020: $9,500,000) was attributable to customers in Europe.

4. Revenue from contracts with customers

All of the Group’s revenue in respect of the years ended 31 December 2021 and 2020 derived from continuing operations and from the design, development and marketing of software products with associated implementation and consultancy services. The following table provides further disaggregation of revenue in accordance with the IFRS 15 requirement to depict how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors.

Perpetual licenses are recognized at a point in time. Consulting and implementation services, and maintenance, subscription and hosting services, are recognized over time.

5. Adjusted EBITDA

Adjusted EBITDA, which is a company specific measure, is defined as earnings before interest, tax, depreciation, amortization and employee share-based payment charges is an important measure, since it is widely used by the investment community. It is calculated by adding back net interest payable of $100,000 (2020: $68,000) and adding back depreciation and amortization charges amounting to $3,974,000 (2020: $3,705,000) and employee share-based payment charges of $880,000 (2020: $447,000) to the profit before tax of $1,227,000 (2020: $1,707,000).

6. Share-Based Payments

In accordance with IFRS 2 Share based Payments, an option pricing model has been used to work out the fair value of share options granted by the Group, with this being charged to the income statement over the expected vesting period and leading to a charge of $880,000 (2020: $447,000). Where an option vests in multiple instalments, each instalment is treated as a separate grant with its own vesting period. The entire expense is recognized within administrative expenses.

7. Income Tax

The current tax expense represents German corporation tax payable by Sopheon GmbH and US state taxes payable by the Group’s US subsidiaries. US corporate Alternative Minimum Tax (AMT) was repealed in respect of tax years beginning on or after 1 January 2018. AMT paid by the Group’s US subsidiaries in respect of periods prior to that date has been fully refunded.

At 31 December 2021, tax losses estimated at $54m (2020: $54m) were available to carry forward by the Sopheon Group, arising from historical losses incurred. These losses have given rise to a deferred tax asset of $2.6m (2020: $2.6m) and a further potential deferred tax asset of $9.1 m (2020: $8.5m), based on the tax rates currently applicable in the relevant tax jurisdictions. An aggregate $8.7m (2020: $8.8m) of these losses are subject to restriction under section 382 of the US Internal Revenue Code due to historical changes of ownership.

8. Earnings per Share

The calculation of basic earnings per ordinary share is based on a profit of $817,000 (2020: $1,496,000), and on 10,442,000 (2020: 10,193,000) ordinary shares, being the weighted average number of ordinary shares in issue during the year. For the purpose of calculating diluted earnings per ordinary share, adjustments are made to the number of ordinary shares to reflect the impact of employee share options to the extent that exercise prices are below the average market price for Sopheon shares during the year. These adjustments had the effect of increasing the number of ordinary shares to 10,939,000 (2020: 10,637,000).

9. Intangible Assets

In accordance with IAS 38 Intangible Assets, certain development expenditure must be capitalized and amortized based on detailed technical criteria, rather than automatically charging such costs in the income statement as they arise. This has led to the capitalization of $4,271,000 (2019: $3,658,000), and amortization of $2,997,000 (2019: $2,669,000) during the year.

On 20 December 2021 the group announced the acquisition of the business and certain assets and liabilities of ROI Blueprints LLC, a cloud-based project and portfolio SaaS solution designed to help organizations drive operational execution management of corporate initiatives. The initial consideration of $1,500,000 comprised cash of $1,460,000 (of which $10,000 was deferred) with the balance satisfied by the assumption of current assets with a fair value of $36,000 and contract liabilities with a fair value of $76,000. Further contingent consideration of up to $1,500,000 is payable pursuant to an earn-out which has been estimated at $1,312,500 based on expectations of performance at the date of this report. The technology and intellectual property rights acquired with the acquisition have been recorded at a fair value of $2,250,000 and the balance of the excess of the consideration over the fair value of the net liabilities acquired of $563,000 has been allocated to goodwill comprising expected synergies and other intangible assets that do not qualify for separate recognition. The technology and IPR will be amortized over 4 years.

10. Cautionary Statement

Sopheon has made forward-looking statements in this press release, including statements about the market for and benefits of its products and services; financial results; product development plans; the potential benefits of business relationships with third parties and business strategies. These statements about future events are subject to risks and uncertainties that could cause Sopheon's actual results to differ materially from those that might be inferred from the forward-looking statements. Sopheon can make no assurance that any forward-looking statements will prove correct.