Sopheon plc, the international provider of software and services for Enterprise Innovation Management solutions, announces its unaudited half-yearly financial report for the six months ended 30 June 2020 together with a business review and outlook statement for the second half of the year.

Highlights:

-

Revenue: $13.9m (2019: $13.7m)

Adjusted EBITDA1: $2.6m (2019: $2.8m)

Net cash: $21.9m (2019: $18.7m)

ARR2: $16.5m (2019: $15.3m) -

Revenue ahead of 2019 in spite of the challenging environment due to the coronavirus pandemic.

-

Total pipeline value and activity has held up with four $1m plus orders signed since the start of the year. The value of new customer sales bookings has doubled year on year, and all new customer licenses were SaaS. Revenue visibility3 for full-year 2020 is now at $25.5m (2019: $25.4m).

-

Gross retention at 94 percent following some recent attrition as customers retrench (2019: 97 percent); more than offset by new orders taking ARR today to $16.5m (2019: $15.3m).

-

Strong balance sheet and cash of $21.9m, a reported high, provide a platform for growth.

Sopheon’s Chairman, Barry Mence said:“Several of Sopheon’s vertical markets – food, beverage and consumables; chemicals; defense – continue to show resilience to the crisis. However, our customer base is not immune to the difficulties faced by the general markets. Like many others, we withdrew market guidance in May, and in view of the traditional fourth quarter weighting in our business, we believe this remains a prudent approach.

Nevertheless, our solutions remain highly attractive to new and existing customers. This is evidenced by revenues slightly ahead of last year, and by continuing sales traction with a doubling of new customer booking value, including major commitments like our recently announced win at Mondelēz International. This also underlines that our SaaS transition is well underway. Visibility for full year 2020 is $25.5m, underpinned by ARR at $16.5m, net cash at $21.9m and a substantial, active sales pipeline - even in the toughest environment in decades, these positive metrics give us a solid platform from which to proceed with our strategy.”

For further information contact:

| Barry Mence, Chairman Arif Karimjee, CFO |

Sopheon plc | + 44 (0) 1276 919 560 |

| Carl Holmes / Giles Rolls (corporate finance) Alice Lane / Sunila de Silva(ECM) |

finnCap Ltd | + 44 (0) 20 7220 0500 |

About Sopheon

Sopheon (LSE: SPE) partners with customers to provide complete enterprise innovation management solutions including software, expertise, and best practices, that enable them to achieve exceptional long-term revenue growth and profitability. Sopheon’s Accolade solution provides unique, fully-integrated coverage for the entire innovation management and new product development lifecycle, including strategic innovation planning, roadmapping, idea and concept development, process and project management, portfolio management and resource planning. Sopheon’s solutions have been implemented by over 250 customers with over 60,000 users in over 50 countries. Sopheon is listed on AIM, operated by the London Stock Exchange.

CHAIRMAN’S STATEMENT

Trading Performance and Results

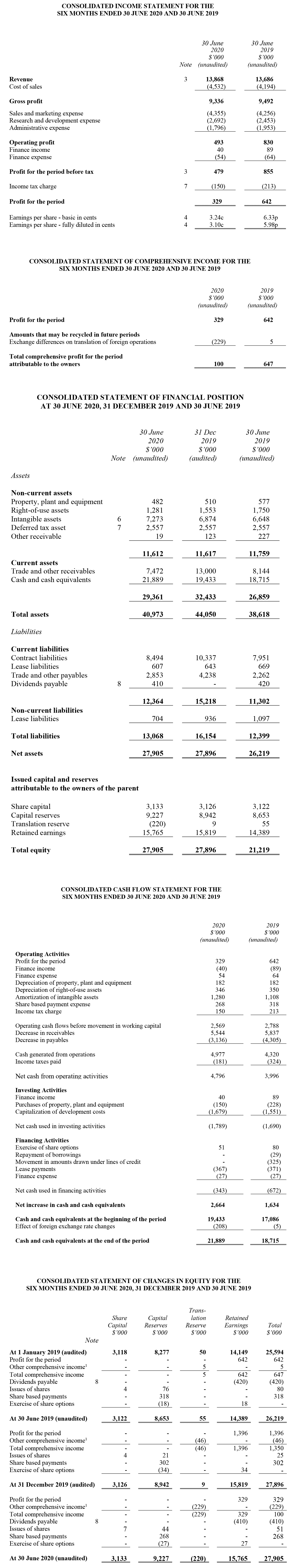

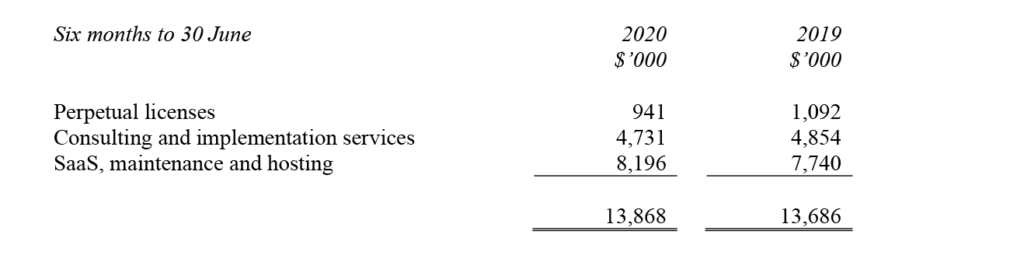

First half revenue was $13.9m compared to $13.7m last year, in spite of the pandemic. As in past years, we look for an acceleration in sales in the second half of the year and our traditional fourth quarter weighting, provided the global circumstances do not take a further turn for the worse. We closed 13 software transactions in the period with 2 from new customers (2019: 18 and 7 respectively). This compares to 7 new customers last year, but with smaller deal sizes. Since the end of June, we have closed another 8 software deals, including a further 2 new customers. All new customers this year have opted for multi-year Software as a Service (SaaS) contracts, in line with our expected shift to a more recurring model. Three of these had total deal value above $1m – in total, the value of new customer sales bookings is over twice what it was last year. A further services order from an existing customer also exceeded $1m. The bulk of the existing customer base continues to represent a perpetual licensing model, and extensions from the base will continue to drive a degree of perpetual licensing for the foreseeable future, though we are also implementing strategies to convert existing licensees to our cloud-based model. Further analysis of revenue is given in Note 3.

Since our last trading update in May, we have seen some increase in customer non-renewal notices or user reduction notices, and our annual recurring revenue (“ARR”) retention rate now stands at approximately 94 percent on a gross basis. In our view this is a respectable outcome in light of the COVID situation. Reasons for non-renewal included budget cuts and M&A. We have more than offset this with new orders, adding $1.5m in new ARR since the start of the year. This means our ARR now stands at $16.5m compared to $15.9m at the start of this year and $15.3m last June. Our net promoter score – a measure of customer satisfaction – remains steady at 40 based on year to date surveys, considered a high score for B2B. We draw a dual conclusion from these data points – our customer base is not immune to the difficulties faced by the broader market, however our solutions remain highly valuable to new and existing customers through the recent turbulent conditions.

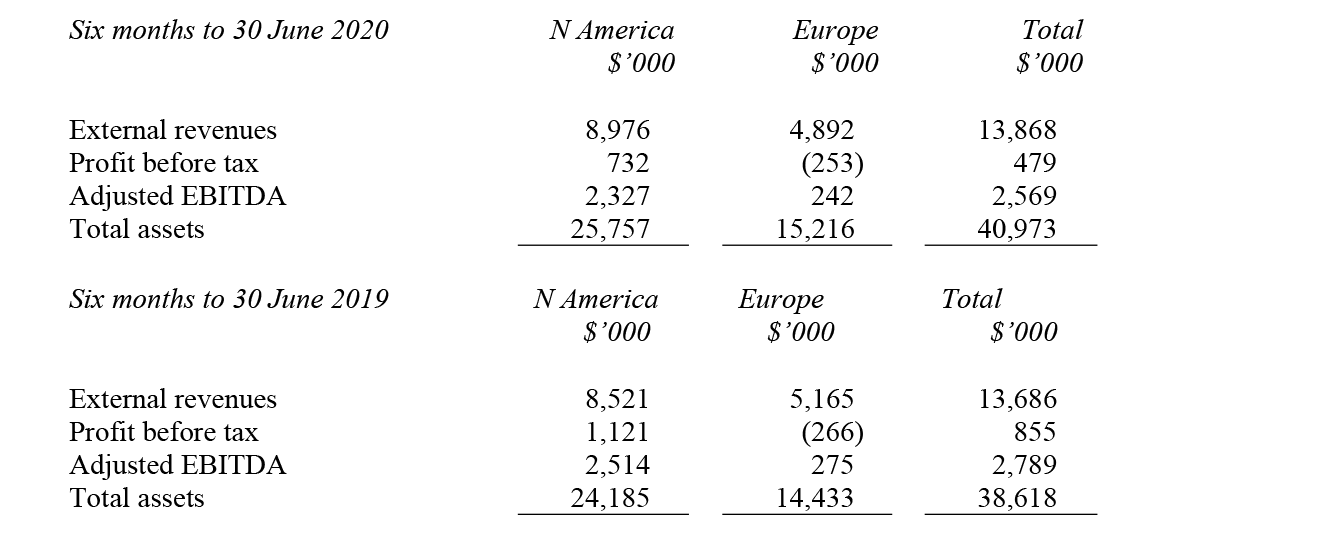

In addition to license orders, we continued to sign substantial service extensions alongside delivery of a range of implementation and upgrade projects. The geographical split of revenue remains roughly two-thirds North America and one-third Europe reflecting historical metrics.

We have continued to book orders from new and existing customers in the third quarter, and can report that revenue visibility today stands at $25.5m (2019: $25.4m). The 12-month forward sales pipeline is holding broadly steady in terms of overall value since the start of the year, which was in turn a big jump from the year before. In line with comments above, the profile of opportunities continues to skew towards SaaS as far as potential new customers are concerned. The total number of opportunities with deal size above $0.5m is up about 10 percent compared to last year. Our commercial teams remain busy and we continue to see traction in our sales efforts; what is less clear is speed to closure. However, we are encouraged by the ongoing level of engagement and by the deals booked as described above. Our partnership with Mondelēz International, announced in early July, is a prime example.

We believe our strategy to transition to SaaS will increase shareholder value over time by delivering a greater lifetime revenue from each customer, and since first referring to this shift in our 2018 annual report, it has become a key internal driver of change. We have revised our standard pricing models, service delivery models and commission plans, and a longer-term migration of the software platform is underway. Year to date, 11 of our license deals are SaaS compared to 5 at this point in 2019. However, experience tells us that full conversion to SaaS will take several years.

Margin and Results

COVID has caused organizations to face new and immediate challenges and opportunities that require urgent, strategic and effective responses. In terms of our own operations, we took early action to ensure the health and safety of staff, introducing an immediate work from home policy supported by well-defined virtual working practices, and we also assured continuity of business operations and cloud services through our co-location and Azure-based infrastructure. This all went smoothly.

Gross margin for the period eased to 67 percent compared with 69 percent in the first half of 2019. Direct costs include costs for license and support for certain OEM components of our solution, costs of our hosting operations, and movements in indirect taxes; but the main component is the cost of our delivery and support teams, and associated subcontractors. The small reduction this year can be attributed to slightly higher headcount and the indirect tax movement.

As noted in the update issued in May this year, we have held back on our original recruitment plans for 2020, which means we had 163 people on staff at the end of June compared to 162 at the end of last year. Average headcount for the period was 162 compared to 156 for the first half last year. Coming into the third quarter we are cautiously hiring again, mainly in the development area as we continue to invest in our cloud conversion strategy. The modest increase in sales and marketing costs from $4.3m to $4.4m reflects the slightly higher staff levels, offset by lower costs in travel and commissions. Net R&D expense in the income statement has risen to $2.7m compared to $2.5m last year. Capitalization of product development costs was $1.7m compared to $1.6m the year before, offset by $1.3m of amortization (2019: $1.1m); accordingly, actual expenditure on R&D activities has increased by around $0.2m. Finally, administrative expenses (which includes all other overheads, office costs, regulatory and compliance costs, and depreciation) reduced to $1.8m compared to $2.0m last year. The reduction can largely be attributed to COVID-related subsidies received in the Netherlands, in addition to exchange movements.

Reflecting the controlled cost increases referenced above, profit before tax reported for the half-year period was $0.5m (2019: $0.9m). This result includes net interest, depreciation and amortization and share-based payment costs amounting to $2.1m (2019: $1.9m). The Adjusted EBITDA result for the first half of 2020, which does not include these elements, was accordingly $2.6m (2019: $2.8m). No adjustment has been recorded to the deferred tax asset, however provision has been made for approximately $0.1m in current tax for US state taxes and German corporation tax (2019: $0.2m), giving a final profit after tax of $0.3m compared to $0.6m the year before. This has translated to basic and diluted EPS of 3.23 and 3.10 cents respectively (2019: 6.33 and 5.98).

Balance Sheet and Corporate

Net assets at 30 June 2020 stood at $27.9m (30 June 2019: $26.2m / 31 December 2019: $27.9m), with cash at the end of the period rising to $21.9m from $19.4m at year end (30 June 2019: $18.7m / 31 December 2019 $19.4m) underlining the continued positive cash generation in the business. Of the cash balance, approximately $10.6m was held in US Dollars, $8.8m in Euros and the balance of $2.4m in Sterling. The Group has no borrowings.

The Group’s $3m revolving line of credit facility with Silicon Valley Bank expired in February 2020 and as we have previously noted was not renewed due to the substantial cash balances in the business. Our relationship with the bank remains strong. The facility was in any case only used on demand, and there were no funds drawn at 30 June 2019 or 31 December 2019.

Intangible assets at 30 June 2020 stood at $7.3m (30 June 2019: $6.6m / 31 December 2019: $6.8m). The total includes (i) $6.3m being the net book value of capitalized research and development (30 June 2019: $5.6m) and (ii) $1.0m (30 June 2019: $1.0m) being the net book value of acquired intangible assets. In addition, as further detailed in Note 7 of the financial statements, in prior periods the Group recognized a $2.6m deferred tax asset, of a total potential deferred tax asset of $10.6m. No change to the asset is proposed at this time. The Group adopted IFRS 16 last year, which requires lessees to recognize a lease liability that reflects future lease payments and a "right-of-use asset" in all lease contracts within scope, with no distinction between financing and operating leases. This has resulted in recognition at 30 June 2020 of right-of-use assets totaling $1.28m (30 June 2019: $1.75m / 31 December 2019: $1.55m) and total lease liabilities of $1.31m (30 June 2019: $1.77m / 31 December 2019: $1.58m).

COVID notwithstanding, on the back of the strong historic performance and substantial cash reserves, the Board decided to maintain the Group’s dividend at 3.25p per share ($0.4m in total). This was approved by the shareholders in the Annual General Meeting held on 11 June 2020, and paid on 10 July 2020.

Strategy and Product

For many of our customers, our Accolade solution offers visibility and speed to decisions in times of crisis; accordingly our vision for the market and our position remains broadly unchanged. Our broadened mission – from a business that helps R&D organizations to improve innovation, to one that helps major enterprises achieve their strategic goals – has dramatically expanded our horizons and potential. In an increasingly digital world, organizations are challenged to operate with more agility and velocity to survive and thrive; this is where Sopheon can add significant value to our customers. The potential addressable market for this opportunity is very substantial. Our vision and ability to execute is noted by leading analyst group Gartner in their 2019 Magic Quadrant for Project & Portfolio Management, 2019 Market Guide for Strategy and Innovation Roadmapping Tools, 2019 Market Guide for Innovation Management and 2019 Market Guide for Strategy Execution Management Software. Gartner most recently called out the deep integration we announced in May of our Accolade software with Microsoft® Teams as an example of what the market needs today in the July 2020 research note “To Enable Effective Remote Work, Build Collaborative Features Natively into Your Software Tools.” Within this context, we continue to focus on and refine our growth strategies as noted in our annual report:

-

Leverage our impressive roster of blue-chip references to extend Accolade as the digital platform of choice to digitalize corporate strategy and operational execution.

-

Generate faster net-new logo growth in target vertical industries through deeper specialization and domain-specific expertise.

-

Multiply our growth through developing and monetizing an Accolade ecosystem of distribution partnerships – channel, strategic and geographical.

-

Engage in M&A only if it propels the speed and competency for Sopheon to achieve the above.

-

Transform to a cloud business.

Clearly, we have seen some interruptions due to the pandemic, but also see continuing opportunity. We have maintained investment in all the above areas – including starting to take a more structured look at M&A opportunities – while also maintaining our rapid pace of new releases for the Accolade platform. We released Accolade version 13.0 at the end of last year, and 13.1 in May – incorporating our new Accolade Connect for Microsoft® Teams, a cloud-only offering considered by analysts to offer a uniquely deep integration as mentioned above – and we are now busy with the next release. As we migrate our business towards the cloud, we are also encouraging existing perpetual customers to move their Accolade instance into our hosting centers, via a compelling cloud-lift offering intended to provide high value to them, and increased recurring revenue to Sopheon.

Outlook

Several of Sopheon’s vertical markets – food, beverage and consumables; chemicals; defense – continue to show resilience to the crisis. However, our customer base is not immune to the difficulties faced by the general markets. Like many others, we withdrew market guidance in May, and in view of the traditional fourth quarter weighting in our business, we believe this remains a prudent approach. Nevertheless, our solutions remain highly attractive to new and existing customers. This is evidenced by revenues slightly ahead of last year, and by continuing sales traction with a doubling of new customer booking value, including major commitments like our recently announced win at Mondelēz International. This also underlines that our SaaS transition is well underway. Visibility for full year 2020 is $25.5m, underpinned by ARR at $16.5m, net cash at $21.9m and a substantial, active sales pipeline - even in the toughest environment in decades, these positive metrics give us a solid platform from which to proceed with our strategy.

| Barry Mence Chairman |

26 August 2019 |

1. Other comprehensive income comprises solely of exchange differences arising on translation of foreign operations.

1. Other comprehensive income comprises solely of exchange differences arising on translation of foreign operations.

Notes to the Consolidated Financial Statements

1. General Information

Sopheon plc is a company domiciled in England. The interim financial information of the Company for the six months ended 30 June 2020 comprise the Company and its subsidiaries (together referred to as the "Group").

The Board of Directors approved this interim report on 26 August 2020.

2. Principle Accounting policies

Basis of preparation and accounting policies

These condensed consolidated financial statements have been prepared using accounting policies based on International Financial Reporting Standards (IFRS and IFRIC Interpretations) issued by the International Accounting Standards Board (“IASB”) as adopted for use in the EU. They do not include all disclosures that would otherwise be required in a complete set of financial statements and should be read in conjunction with the 31 December 2019 Annual Report. The financial information for the half years ended 30 June 2020 and 30 June 2019 does not constitute statutory accounts within the meaning of Section 434 (3) of the Companies Act 2006 and both periods are unaudited.

The annual financial statements of Sopheon Plc (‘the Group’) are prepared in accordance with IFRS as adopted by the European Union. The statutory Annual Report and Financial Statements for 2019 have been filed with the Registrar of Companies. The Independent Auditors’ Report on the Annual Report and Financial Statements for the year ended 31 December 2019 was unqualified, did not draw attention to any matters by way of emphasis and did not contain a statement under 498(2) - (3) of the Companies Act 2006.

The Group has applied the same accounting policies and methods of computation in its interim consolidated financial statements as in its 31 December 2019 annual financial statements, except for those that relate to new standards and interpretations effective for the first time for periods beginning on (or after) 1 January 2020 and will be adopted in the 2020 financial statements. There are deemed to be no new and amended standards and/or interpretations that will apply for the first time in the next annual financial statements that are expected to have a material impact on the Group.

Going Concern

The consolidated financial statements have been prepared on a going concern basis. In reaching their assessment, the directors have considered a period extending at least 12 months from the date of approval of this half-yearly financial report. As is widely understood and discussed in more detail in note 10 below, the COVID-19 global pandemic has had a widespread impact economically, with potential for causing delays in contract negotiations and/or cancellation of anticipated sales, as well as uncertainty over cash collection from certain customers. As a consequence, the Group has carried out detailed forecast stress testing, assessing how much forecasts would need to reduce by in order to cause cash constraints, and also to consider the likelihood of this scenario occurring. The results of this analysis have given the directors comfort that a scenario which would cause these cash restrictions is remote, and therefore not a realistic outcome to consider. This assessment has also included the Group’s actual cash holdings as of the date of the approval of this report, and the financing alternatives available. Accordingly, the Group’s cashflows are projected to be at a sufficient level to allow the Group to meet its obligations and liabilities as they fall due. Thus, the directors of the Company continue to adopt the going concern basis of accounting in preparing the financial statements.

Revenue Recognition

Revenue is measured at the fair value of the consideration received or receivable and represents amounts receivable for goods and services provided in the normal course of business, net of discounts and sales-related taxes.

Sales of software licenses are recognized once no significant obligations remain owing to the customer in connection with such license sale. Such significant obligations could include giving a customer a right to return the software product without any preconditions, or if the Group is unable to deliver a material element of the software product by the balance sheet date.

Revenues relating to software subscription, maintenance and hosting agreements are deferred creating a contract liability at the period end, and then recognized evenly over the term of the agreements.

Revenues from implementation and consultancy services are recognized as the services are performed, or in the case of fixed price or milestone-based projects, on a percentage basis as the work is completed and any relevant milestones are met, using latest estimates to determine the expected duration and cost of the project. Based on stage of completion and billing arrangement, either a contract asset or a contract liability is created at the period end.

Deferred Tax

Deferred tax is recognized on differences between the carrying amounts of assets and liabilities in the financial statements and the corresponding tax bases used in the computation of taxable profit, and is accounted for using the balance sheet liability method. Deferred tax liabilities are generally recognized for all taxable temporary differences. Deferred tax assets are recognized only to the extent that the level and timing of taxable profits can be measured and it is probable that these will be available against which deductible temporary differences can be utilized.

Deferred tax is calculated at tax rates that have been enacted or substantively enacted at the balance sheet date, and that are expected to apply in the period when the liability is settled or the asset realized. Deferred tax is charged or credited to profit or loss, except when it relates to items charged or credited directly to equity, in which case the deferred tax is also dealt with in equity.

Internally Generated Intangible Assets (Research and Development Expenditure)

Development expenditure on internally developed software products is capitalized if it can be demonstrated that:

-

it is technically feasible to develop the product;

-

adequate resources are available to complete the development;

-

there is an intention to complete and sell the product;

-

the Group is able to sell the product;

-

sales of the product will generate future economic benefits; and

-

expenditure on the product can be measured reliably.

Development costs not satisfying the above criteria and expenditure on the research phase of internal projects are recognized in the income statement as incurred. Capitalization of a particular activity commences after proof of concept, requirements and functional concept stages are complete. Capitalized development costs are amortized over the period over which the Group expects to benefit from selling the product developed. This has been estimated to be four years from the date of code-finalization of the applicable software release. The amortization expense in respect of internally generated intangible assets is included in research and development costs.

3. Revenue, Segmental Analysis and EBITDA

All of the Group’s revenues in respect of the six month periods ended 30 June 2020 and 2019 derived from the design, development and marketing of software products with associated implementation and consultancy services. The following table disaggregates revenue in accordance with the IFRS 15 requirement to depict how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors.

For management purposes, the Group is organized across two principal geographic operating segments, as used in the Group’s last annual financial statements. The first segment is North America, and the second Europe. Information relating to these two segments is given below.

All information provides analysis by location of operations. Profit before tax and EBITDA are stated after deducting an estimate for intra-group charges.

Adjusted EBITDA is arrived at after adding back net finance costs, depreciation, amortization and share-based payment expense amounting to $2,090,000 (2019: $1,933,000) to the profit before tax. Details of these amounts are set out in the consolidated cash flow statement. Adjusted EBITDA is a key indicator of the underlying performance of our business, commonly used in the technology sector. It is also a key metric for management and the financial analyst community.

4. Earnings Per Share

The calculation of basic earnings per ordinary share is based on earnings of $329,000 (2019: $642,000) and on 10,178,929 ordinary shares (2019: 10,146,617) being the effective weighted average number of ordinary shares in issue during the period.

For the purpose of calculating the diluted earnings per ordinary share, any options to subscribe for Sopheon shares at prices below the average share price prevailing during the period are treated as exercised at the later of 1 January 2020 or the grant date. The treasury stock method is then used, assuming that the proceeds from such exercise are reinvested in treasury shares at the average market price prevailing during the period. The diluted number of shares used at 30 June 2020 is 10,611,854 (2019: 10,726,181)

5. Revenue Visibility

Revenue visibility at any point in time comprises revenue expected from (i) closed license orders, including those which are contracted but conditional on acceptance decisions scheduled later in the year; (ii) contracted services business delivered or expected to be delivered in the year; and (iii) recurring maintenance, hosting and license subscription streams. The visibility calculation does not include revenues from new sales opportunities expected to close during the remainder of 2020.

6. Intangible Assets

Certain development expenditure is required to be capitalized and amortized based on detailed technical criteria (note 2) rather than automatically charging such costs in the income statement as they arise. This has led to the capitalization of $1,679,000 (2019: $1,551,000), and amortization of $1,280,000 (2019: $1,108,000) during the period.

7. Taxation

The tax charge reflects certain US state taxes and German corporate taxes. At 30 June 2020, income tax losses estimated at $52m (2019: $53m) were available to carry forward by the Group, arising from historic losses incurred at the US federal level and also in the UK and the Netherlands. These losses have given rise to a recognized deferred tax asset of $2.6m (2019: $2.6m) and a further, but currently unrecognized, potential deferred tax asset of $8.0m (2019: $8.2m), based on the tax rates currently applicable in the relevant tax jurisdictions. An aggregate $9m (2019: $9m) of these tax losses are subject to restriction under section 392 of the US Internal Revenue Code, whereby the ability to utilize net operating losses arising prior to a change of ownership is limited to a percentage of the entity value of the corporation at the date of change of ownership.

In addition to income taxes, the Group is also subject to sales and value added tax in the various jurisdictions in which it operates.

8. Dividend

The Board has proposed a final dividend in respect of the year ended 31 December 2019 of 3.25p per share (2018: 3.25p per share). This was approved by the shareholders in the annual general meeting held on 11 June 2020 and an amount of $410,000 is shown within current liabilities in the statement of financial position as at 30 June 2020.

9. Principal Risks and Uncertainties

There are a number of potential risks and uncertainties which could have a material impact on the Group's performance over the remaining six months of the financial year and could cause actual results to differ materially from expected and historical results. The directors do not consider that the principal risks and uncertainties have changed since the publication of the annual report for the year ended 31 December 2019, which contains a detailed explanation of the risks relevant to the Group on page 28, and is available at www.sopheon.com. Since the 2019 Annual Report, the Board have been monitoring and mitigating the effects of the following international events on the Group’s business:

COVID-19

In March 2020, the World Health Organization declared a global pandemic due to the COVID-19 virus that has spread across the globe, causing different governments and countries to enforce restrictions on people movements, a stop to international travel, and other precautionary measures. This has had a widespread impact economically and has resulted in difficulties in certain industries and a more general need to consider whether budgets and targets previously set are realistic, with potential for delays or cancellation of anticipated sales and possible uncertainty over cash collection. The Board believes that Sopheon is well positioned to be able to navigate through the impact of COVID-19 due to the strength and flexibility of its service proposition, its strong balance sheet and cash position. The only COVID-related subsidies receivable by the group are in the Netherlands, being a contribution to payroll costs based on estimated reduction in turnover of the Dutch subsidiary in May, June and July 2020. An advance of $0.3m was received in the period, being 80% of the total potential subsidy, and the group has recognized two thirds of this amount being the period relating to May and June.

Brexit

The UK formally left the EU on 30 January 2020. The UK is now in a transition period, being an intermediary arrangement covering matters like trade and border arrangements, citizens’ rights and jurisdiction on matters including dispute resolution. The transition period is currently due to end on 31 December 2020 and negotiations are ongoing to determine and conclude a formal agreement. As the Group operates subsidiaries in many countries, there are several channels available to us to continue business with the same customers, should the need arise, with little to no effect from Brexit changes. As such, while the Directors are closely monitoring the situation, they currently deem that the effects of Brexit will not have a significant impact on the Group’s operations.

Other principal risks and uncertainties of the Group for the remaining six months of the current financial year are disclosed in the Chairman’s Statement and the notes to the interim financial information included in this half-yearly financial report.

10. CAUTIONARY STATEMENT

This report contains certain forward-looking statements with respect to the financial condition, results of operations and businesses of Sopheon plc. These statements are made by the directors in good faith based on the information available to them up to the time of their approval of this report. However, such statements should be treated with caution as they involve risk and uncertainty because they relate to events and depend upon circumstances that will occur in the future. There are a number of factors that could cause actual results or developments to differ materially from those expressed or implied by these forward-looking statements. Nothing in this announcement should be construed as a profit forecast.

The information communicated in this announcement is inside information for the purposes of

Article 7 of Regulation 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse.

Introduction

We have been engaged by Sopheon plc (the “Company”) to review the condensed set of financial statements in the half-yearly financial report for the six months ended 30 June 2020 which comprises the consolidated income statement; consolidated statement of comprehensive income; consolidated statement of financial position; consolidated cash flow statement; consolidated statement of changes in equity; and associated notes.

We have read the other information contained in the half-yearly financial report and considered whether it contains any apparent misstatements or material inconsistencies with the information in the interim financial information.

Directors’ Responsibilities

The interim financial report, including the financial information contained therein, is the responsibility of and has been approved by the directors. The directors are responsible for preparing the interim financial report in accordance with the rules of the London Stock Exchange for companies trading securities on AIM, which require that the financial information must be presented and prepared in a form consistent with that which will be adopted in the Company's annual financial statements having regard to the accounting standards applicable to such annual financial statements.

Our Responsibility

Our responsibility is to express to the Company a conclusion on the condensed set of financial statements in the half-yearly report based on our review.

Our report has been prepared in accordance with the terms of our engagement to assist the Company in meeting the requirements of the rules of the London Stock Exchange for companies trading securities on AIM and for no other purpose. No person is entitled to rely on this report unless such a person is a person entitled to rely upon this report by virtue of and for the purpose of our terms of engagement or has been expressly authorized to do so by our prior written consent. Save as above, we do not accept responsibility for this report to any other person or for any other purpose and we hereby expressly disclaim any and all such liability.

Scope of Review

We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410, ‘Review of Interim Financial Information Performed by the Independent Auditor of the Entity’, issued by the Auditing Practices Board for use in the United Kingdom. A review of interim financial information consists of making enquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing (UK) and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the condensed set of financial statements in the half-yearly financial report for the six months ended 30 June 2020 is not prepared, in all material respects, in accordance with the rules of the London Stock Exchange for companies whose shares are admitted to trading on AIM.

BDO LLP

Chartered Accountants & Registered Auditors, London, United Kingdom

26 August 2020

BDO LLP is a limited liability partnership registered in England and Wales (with registered number OC305127).