Sopheon plc (“Sopheon”) the international provider of software and services that improve the return from innovation and product development investments, announces its unaudited interim report for the six months ended 30 June 2011 (the “period”) together with a business review and outlook.

Highlights:

-

Revenue: £4.7m (2010: £4.7m)

EBITDA profit: £0.4m (2010: £0.6m)

Loss before tax: £0.3m (2010: £0.1m) -

Twenty-two license transactions completed including extension sales.

-

Revenue visibility for full-year 2011 now stands at £8.5m compared to £6.6m reported in mid-June at the time of our AGM, and represents 80% of Sopheon’s total revenues for the full year 2010. At the time of publication of our 2010 interim report, visibility was £8.2m.

-

Cash at 30 June stood at £3.1m (2010: £1.7m).

-

Vertical marketing strategies launched in May and June have thus far generated interest from more than 240 prospective buyers, with early-stage funnel activity continuing to build.

Sopheon’s Chairman, Barry Mence said: We have a market-leading product set; an excellent reference base of blue-chip customers; great people; the funding to continue measured expansion; targeted marketing programs; and a number of partnership and reseller relationships. Armed with these resources, we will continue to focus our attention on accelerating the growth of our business.

For Futher Information Contact:

| Barry Mence, Chairman | Sopheon plc | Tel : + 44 (0) 1483 685 735 |

| Arif Karimjee, CFO | Sopheon plc | Tel : + 44 (0) 1483 685 735 |

| Charles Cunningham / Charlotte Stranner / Joanna Weaving | finnCap | Tel : + 44 (0) 20 7600 1658 |

| Nicholas Nelson / Guy McDougall | Hansard (Financial PR) | Tel : + 44 (0) 20 7245 1100 |

| Claire Verhagen | Citigate First Financial | Tel : + 31 (0) 205 754 010 |

Sopheon (LSE: SPE) is an international provider of software and services that help organisations improve the business impact of product innovation. Sopheon's solutions automate and govern the innovation process, enabling companies to increase revenue and profits from new products. Sopheon's solutions are used by industry leaders throughout the world, including BAE Systems, BASF, Corning, Electrolux, Honeywell, Novartis and SABMiller. Sopheon is listed on the AIM Market of the London Stock Exchange and on the Euronext in the Netherlands.

Chairman's Statement

Trading Performance

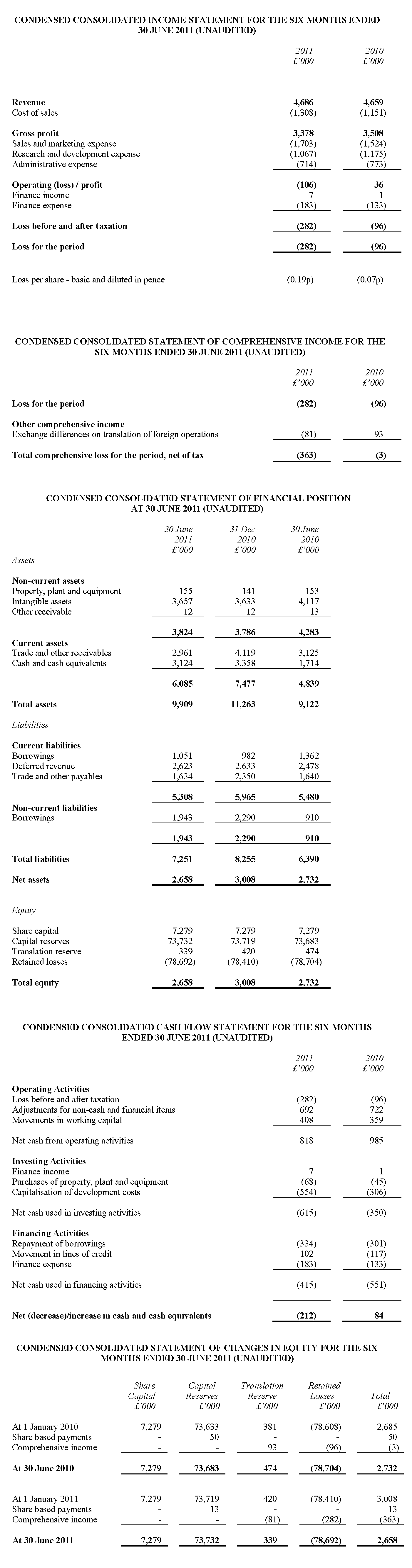

First half revenues in 2011 were £4.7m, compared to £4.7m in 2010, and £4.1m in 2009. The overall revenue mix between license, service and maintenance amounted to 27:32:41 respectively, compared to 36:27:37 in the first half of 2010. Both services and maintenance showed strong growth, but license fees were lower.

The revenue profile noted above is reflected in sales performance metrics; during the six-month period 22 new and extension license orders were booked, compared to 24 the year before. However, consultancy and services contracts grew substantially. At the mid-year point, our recurring base of maintenance, hosting and rental contracts stands at £3.9m compared to £3.7m a year ago. We experienced some termination activity during the period as a result of customer reorganization and rationalization activity. Revenue visibility has improved to £8.5m compared to £6.6m at the time of our Annual General Meeting in June.

The first half of 2010 benefited from a very strong close, including one particularly large individual order. Although we had a number of sizeable orders in the first half of 2011, none were of this magnitude. A few deals that we were driving to close by 30 June spilled over the end of the half-year period and were signed during the first week of July. In addition to the operational matters referred to above, some softening in the GBP/USD exchange rate year on year has negatively impacted revenues by approximately £0.15m.

Our sales pipelines for the third quarter and beyond are healthy and are expected to drive additional increases in revenue visibility between now and the end of the year. Nevertheless, wider market uncertainty has increased sharply in recent weeks. As we have noted in our previous announcements, predicting the timing and value of individual sales is challenging, and this can impact revenue performance in a particular period.

Approximately 59% of revenues during the first half of the year were generated by US customers (2010: 60%) with the balance predominantly from Europe. The contribution from Europe is slightly higher than in previous years. Vision Strategist accounted for 10% of total revenues recorded in the first half of 2011 compared to 9% for all of 2010. Gross margin, which is arrived at after charging direct costs such as payroll for client services staff, was 72% compared to 75% in 2010. We expect the gross margin percentage to continue to fluctuate from period to period, in line with the uneven mix of license revenue.

Operating Costs and Results

Due to the headcount adjustments made last year, our cost base has changed. Average staff count during 2010 was 84. As previously noted, we began targeted recruitment in the final quarter of last year including new leadership for key areas. At the end of June headcount stood at 97, augmented by contracting with partners. The investment in additional headcount is tied to our growth strategies. For example, we are investing in additional sales representation to support our business development efforts in the German market. These actions have led to a higher cost base than the previous year.

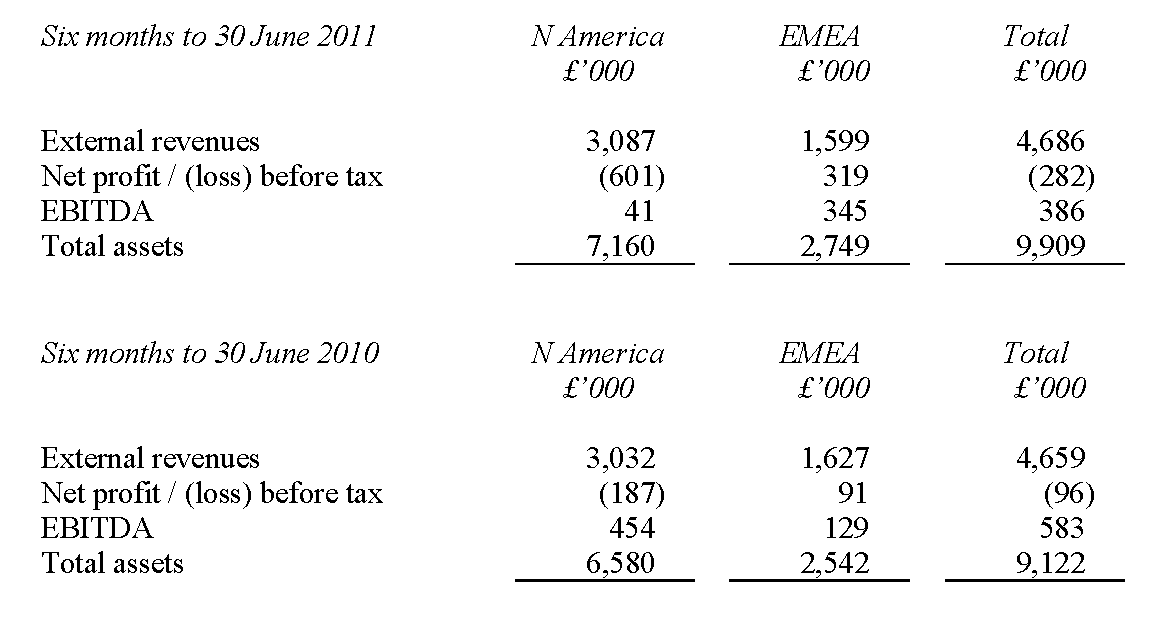

The overall operating result for the business during the period was a loss of £106,000 (2010: profit of £36,000). After net finance costs, which include interest on debt taken on to finance the Alignent acquisition, the final loss before tax reported for the period is £282,000 (2010: loss of £96,000). This result includes interest, depreciation and amortisation costs amounting to £668,000 (2009: £679,000). The EBITDA result for the first half of 2011, which does not include these elements, was a profit of £386,000 (2010: £583,000).

Corporate and Balance Sheet

Net assets at 30 June 2011 stood at £2.7m (2010: £2.7m). Cash resources at the end of the period amounted to £3.1m (2010: £1.7m). Approximately £1.8m was held in US dollars, £1.1m in Euros and £0.1m in Sterling.

Intangible assets at 30 June 2011 stood at £3.7m (2010: £4.1m). This includes (i) £2.6m being the net book value of capitalised research and development (2010: £2.5m) and (ii) £1.1m (2010: £1.6m) being the net book value of Alignent intangible assets acquired in 2007.

The group has a $3.5 million mezzanine term loan with BlueCrest Capital Finance (“BlueCrest”). This loan is repayable in equal monthly instalments through to March 2014. BlueCrest has also provided the Group with a revolving credit facility secured on US accounts receivables, annually renewable in November and with a facility limit of $1.25m. At 30 June 2011, the balances outstanding on the medium-term debt and revolving credit facility were $2.96m (2010: $1.1m) and $0.65m respectively (2010: $0.7m). The equivalent figures in Sterling are £1.8m (2010: £0.7m) and £0.4m (2010: £0.7m) respectively.

The Group issued £850,000 of convertible unsecured loan stock in October 2009 to a number of investors including key members of the Board and senior management team. The conversion price of the loan stock is 7.75p per ordinary share, and the maturity date is 31 January 2013.

Market and Product

At this year’s Annual General Meeting we stated that Sopheon’s growth strategies for 2012 and beyond centre on three key objectives:

-

Increase our rate of growth by deploying vertical-specific marketing strategies

-

Broaden the use of our solutions within existing accounts

-

Expand direct and indirect distribution channels to generate new accounts

Deploy Vertical Marketing Strategies

Sopheon’s vertical marketing strategies are designed to leverage our already substantial account base. Targeted sectors include consumer packaged goods, and aerospace & defence. Our marketing approach comprises a vertical-specific, integrated mix of tactics ranging from digital advertising campaigns and web-based events to conferences, direct mail and social media programs. Prospect interest generated by these activities is followed up by members of our account management team. Year to date, our vertical programs have attracted the interest of more than 240 prospective buyers. We will continue to build on the success of these programs, complementing our marketing activity with investment in the development of vertical-specific software solutions.

Broaden Solution Use within Existing Accounts

In 2010 Sopheon introduced a number of new product modules for our core Accolade(R) solution. The expectation was that these new capabilities would deepen our value proposition both to prospects and to existing customers, and that they would enable us to generate additional revenue growth from our account base.

More recently we invested in development of an account management program, hiring a team of experienced inside sales professionals whose focus includes selling additional products and services to current customers. This program is showing early signs of positive impact, leading directly to sales of Accolade Portfolio CenterTM, Accolade Idea LabTM and Accolade Vision StrategistTM to existing accounts. We expect these results to continue to build and to contribute significantly to future growth.

The increase in our service revenues during the first half of the year includes new sales resulting from the introduction of services that help customers optimize the value of our software, and assist them in managing their products after they have been launched. As economic pressures and uncertainty persist, a growing number of accounts are also coming to us for help in using our software to make product innovation decisions, portfolio adjustments and business course-corrections quicker, and with greater confidence. With prolonged economic instability taking its toll on more and more companies every day, we expect that the conditions underpinning service and licenses revenue from our existing customers will continue.

Expand Direct and Indirect Distribution Channels to Generate New Accounts

Sopheon’s plans for 2011 include investing in the expansion of our direct sales channel. As noted earlier, our execution of those plans in the first half included widening direct coverage to increase our presence and growth in Germany. We are making similar investments in North America with the explicit goal of increasing our sales to new accounts. We expect initial results from our German investment in the fourth quarter. Overall, we expect that the momentum resulting from our channel investments in both Germany and North America during 2011 will pay significant growth dividends in 2012.

We also continue to expand our indirect channel, and are experiencing growth through a number of consulting partners with whom we are working to broaden the market. These relationships have played key roles in the development of business opportunities at several major customers. We will continue to collaborate with partners on vertical strategies aimed at accelerating revenue generation. In some cases, these relationships involve the joint development of new offerings, one of which will be introduced to the market in the second half of this year. We would expect the business return on this activity to come through in 2012.

Outlook

Market interest in Sopheon’s solutions remains high. Nearly twice as many prospective buyers visited our website and responded to our promotional campaigns in the first half of the year, compared to the same period in 2010. This surge is partly attributable to prominent affirmation of the value of our software by influential third-party sources, including analysts and industry publications. One of our principal advantages is that Sopheon’s unique software suite, which, provides end-to-end support encompassing product strategy, ideation and product development process execution.

After a successful 2010, we came into the year very encouraged by the continued strength of our sales pipeline. Thanks to the improvements made to our working capital position at the end of last year, we have the stability to execute our strategy with confidence, and hire the resources we need. Global economic conditions aside, we are confident the progress and momentum we are building through our investments in 2011 will contribute to accelerated growth in 2012 and beyond.

| Barry Mence Chairman |

24 August 2011 |

Visibility at any point in time comprises revenue expected from (i) closed license orders, including those which are contracted but conditional on acceptance decisions scheduled later in the year; (ii) contracted services business delivered or expected to be delivered in the year; and (iii) recurring maintenance, hosting and rental streams. The visibility calculation does not include revenues from new sales opportunities expected to close during the remainder of 2011.

Trademarks

Accolade®, Idea Lab™ and Vision Strategist™ are trademarks of Sopheon plc. All other trademarks are the sole property of their respective owners.

Cautionary Statement

This Interim Report has been prepared solely to provide additional information to shareholders to assess the Group's strategies and the potential for these strategies to succeed. The Interim Report should not be relied on by any other party or for any other purpose. The Interim Report contains certain forward-looking statements with respect to the financial condition, results of operations and businesses of Sopheon plc. These statements are made by the directors in good faith based on the information available to them up to the time of their approval of this report. However, such statements should be treated with caution as they involve risk and uncertainty because they relate to events and depend upon circumstances that will occur in the future. There are a number of factors that could cause actual results or developments to differ materially from those expressed or implied by these forward-looking statements. The continuing uncertainty in global economic outlook inevitably increases the economic and business risks to which the Group is exposed. Nothing in this announcement should be construed as a profit forecast.

Notes to the Financial Statements

1. General information

Sopheon Plc (the "Company") is a company domiciled in England. The condensed consolidated financial statements of the Company for the six months ended 30 June 2011 comprise the Company and its subsidiaries (together referred to as the "Group").

2. Accounting policies

Basis of preparation

These condensed consolidated financial statements have been prepared in accordance with IAS 34 "Interim Financial Reporting", as adopted by the European Union. They do not include all disclosures that would otherwise be required in a complete set of financial statements and should be read in conjunction with the Annual Report and financial statements for the year ended 31 December 2010. The comparative financial information for the year ended 31 December 2010 included within this interim report does not constitute the full statutory accounts for that period. The Annual Report and Financial Statements for 2010 have been filed with the Registrar of Companies. The Independent Auditors' Report on that Annual Report and Financial Statement for 2010 was unqualified and did not contain a statement under 498(2) or 498(3) of the Companies Act 2006. However, consistent with prior years, it did draw attention to an emphasis of matter due to uncertainty over going concern. The financial information for the half years ended 30 June 2011 and 30 June 2010 is unaudited.

Going concern

The condensed consolidated financial statements have been prepared on a going concern basis. In reaching their assessment, the directors have considered a period extending at least 12 months from the date of approval of this report. This assessment has included consideration of the forecast performance of the business for the foreseeable future, the cash and financing facilities available to the group, and the repayment terms in respect of the group’s borrowings, including the potential of having to repay convertible loan stock in January 2013.

In the first half of 2011, the Group achieved revenues of £4.7m and incurred a loss of £0.3m. This represents a comparable performance to the previous year, albeit impacted with a slightly higher cost base. The Group’s sales pipeline remains very active, and accordingly, the directors remain positive about the prospects for the business.

The Group has a loan note from BlueCrest Capital Finance (“BlueCrest”) which is repayable in equal monthly instalments of $90,000 plus interest through to March 2014. The balance remaining due on the note at 30 June 2011 was $2,962,000 (£1,845,000). The Group also has access to a $1,250,000 revolving line of credit with BlueCrest which is secured against the trade receivables of Sopheon’s North American business. This is annually renewable and the current term expires 30 November 2011. At 30 June 2011, $650,000 (£405,000) was drawn against this revolving facility. In addition, the Group has received a convertible loan of £850,000, repayable or convertible by 31 January 2013. At 30 June 2011, the Group reported net assets of £2.7m and cash resources of £3.1m.

Notwithstanding the group’s funding and trading position, the time-to-close and the order value of individual sales continues to vary considerably. When combined with the relatively low-volume and high-value nature of the group’s business, these are factors which constrain the ability to accurately predict revenue performance. In addition, to meet its strategic objectives, the group is expanding staff. If sales fall short of expectations, there is a risk that the group’s facilities may prove insufficient to cover both operating activities and the repayment of its debt facilities, being on the one hand the regular repayment of the BlueCrest term loan and on the other hand, the possibility of having to repay in cash £850,000 of convertible loan stock on 31 January 2013. In such circumstances, the group would be obliged to seek additional funding.

The directors have concluded that the circumstances set forth above represent material uncertainties, which may cast significant doubt upon the Group’s ability to continue as a going concern, however they believe that taken as a whole, the factors described above enable the Group to continue as a going concern for the foreseeable future. The financial information does not include the adjustments that would be required if the Group were unable to continue as a going concern.

Changes in accounting policies

The same accounting policies, presentation and methods of computation are followed in these condensed consolidated financial statements as were applied in the Group's latest annual audited financial statements.

A number of new or amended IFRSs and IFRIC interpretations have become effective since the last annual report but none of these have had a material impact on the Group's reporting.

3. Segmental Analysis

All of the Group’s revenues in respect of the six month periods ended 30 June 2011 and 2010 derived from the design, development and marketing of software products with associated implementation and consultancy services. For management purposes, the Group is organised across two principal operating segments, which can be expressed geographically. This basis is the same as that used in the Company’s last annual financial statements. The first segment is North America, and the second EMEA (Europe, Middle East and Africa). Information relating to these two segments is given below. All information provides analysis by location of operations.

4. Earnings per share

The calculation of basic earnings per ordinary share is based on a loss of £282,000 (2010 – loss of £96,000) and on 145,579,027 ordinary shares (2010 – 145,579,027) being the weighted average number of ordinary shares in issue during the year. The diluted loss per ordinary share for both 2011 and 2010 are the same as the basic loss per ordinary share in each year, because the exercise of conversion rights attaching to the convertible loan stock would have the effect of reducing the loss per ordinary share and was therefore not dilutive. All warrants and share options to subscribe for ordinary shares either have a strike price above the average market price for the year, or have an immaterial impact.

5. Intangible Assets

In accordance with IAS 38 Intangible Assets, certain development expenditure must be capitalised and amortised based on detailed technical criteria, rather than automatically charging such costs in the income statement as they arise. This has led to the capitalisation of £553,000 (2010: £306,000), and amortisation of £334,000 (2010: £363,000) during the period. In addition, amortisation of £105,000 (2010: £130,000) has been charged during the period against the intangible assets originally acquired with Alignent, in June 2007.

6. Related party transactions

There were no related party transactions required to be disclosed in any period. Transactions between the company and its subsidiary undertakings, which are related parties, have been eliminated on consolidation and are not disclosed in this note.

7. Principal Risks and Uncertainties

There are a number of potential risks and uncertainties which could have a material impact on the Group's performance over the remaining six months of the financial year and could cause actual results to differ materially from expected and historical results. The directors do not consider that the principal risks and uncertainties have changed since the publication of the annual report for the year ended 31 December 2010. The continuing uncertainty in the global economic outlook inevitably increases the trading and balance sheet risks to which the Group is exposed. Other principal risks and uncertainties of the Group for the remaining six months of the current financial year are disclosed in the Chairman’s Statement and the notes to the condensed consolidated financial statements included in this interim report. A more detailed explanation of the risks relevant to the group is on page 21 of the annual report which is available at www.sopheon.com.

8. Statement of Directors Responsibilities

The Directors confirm to the best of their knowledge:

-

The unaudited condensed consolidated financial statements has been prepared in accordance with IAS 34 “Interim Financial Reporting” as adopted by the EU; and

-

The interim report includes a fair review of the information required by DTR 4.2.7R and DTR 4.2.8R of the Disclosure and Transparency Rules of the UK Financial Services Authority.

| On behalf of the Board | 24 August 2011 | |

| Barry Mence | Andy Michuda | Arif Karimjee |

| Chairman | Chief Executive Officer | Chief Financial Officer |

Independent Review Report To Sopheon PLC

Introduction

We have been engaged by the Company to review the condensed set of financial statements in the half-yearly financial report for the six months ended 30 June 2011 which comprises the condensed consolidated income statement; condensed consolidated statement of comprehensive income; condensed consolidated statement of financial position; condensed consolidated cash flow statement; condensed consolidated statement of changes in equity; and associated notes. We have read the other information contained in the half-yearly financial report and considered whether it contains any apparent misstatements or material inconsistencies with the information in the condensed set of financial statements.

Directors’ responsibilities

The interim report, including the financial information contained therein, is the responsibility of and has been approved by the directors. The directors are responsible for preparing the interim report in accordance with the rules of both the London Stock Exchange for companies trading securities on the Alternative Investment Market and Euronext Amsterdam which require that the half-yearly report be presented and prepared in a form consistent with that which will be adopted in the Company's annual accounts having regard to the accounting standards applicable to such annual accounts.

Our responsibility

Our responsibility is to express to the Company a conclusion on the condensed set of financial statements in the half-yearly financial report based on our review. Our report has been prepared in accordance with the terms of our engagement to assist the Company in meeting the requirements of the rules of both the London Stock Exchange for companies trading securities on the Alternative Investment Market and Euronext Amsterdam and for no other purpose. No person is entitled to rely on this report unless such a person is a person entitled to rely upon this report by virtue of and for the purpose of our terms of engagement or has been expressly authorised to do so by our prior written consent. Save as above, we do not accept responsibility for this report to any other person or for any other purpose and we hereby expressly disclaim any and all such liability.

Scope of review

We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410, ‘‘Review of Interim Financial Information Performed by the Independent Auditor of the Entity’’, issued by the Auditing Practices Board for use in the United Kingdom. A review of interim financial information consists of making enquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing (UK and Ireland) and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the condensed set of financial statements in the half-yearly financial report for the six months ended 30 June 2011 is not prepared, in all material respects, in accordance with the rules of the London Stock Exchange for companies trading securities on the Alternative Investment Market and for the rules governing listed securities on Euronext Amsterdam.

Emphasis of Matter - Going concern

In arriving at our review conclusion, which is not modified, we have considered the adequacy of the disclosures made in Note 2 regarding the Group's ability to continue as a going concern. As in prior periods, these disclosures identify certain factors that indicate the existence of material uncertainties which may cast significant doubt over the Group’s ability to continue as a going concern. As discussed in Note 2, the appropriateness of the going concern basis remains reliant on the Group achieving an adequate level of sales in order to maintain sufficient working capital to support its activities, and the possibility of having to repay in cash £850,000 of convertible loan stock on 31 January 2013, or if this objective is not met, being able to raise sufficient additional finance. The financial statements do not include the adjustments that would result if the group were unable to continue as a going concern.

BDO LLP

Chartered Accountants & Registered Auditors, London, United Kingdom

24 August 2011

BDO LLP is a limited liability partnership registered in England and Wales (with registered number OC305127).