Sopheon plc (“Sopheon”) the international provider of software and services that improve the return from innovation and product development investments, announces its unaudited interim results for the six months ended 30 June 2010 (the “period”) together with a business review and outlook.

Highlights:

-

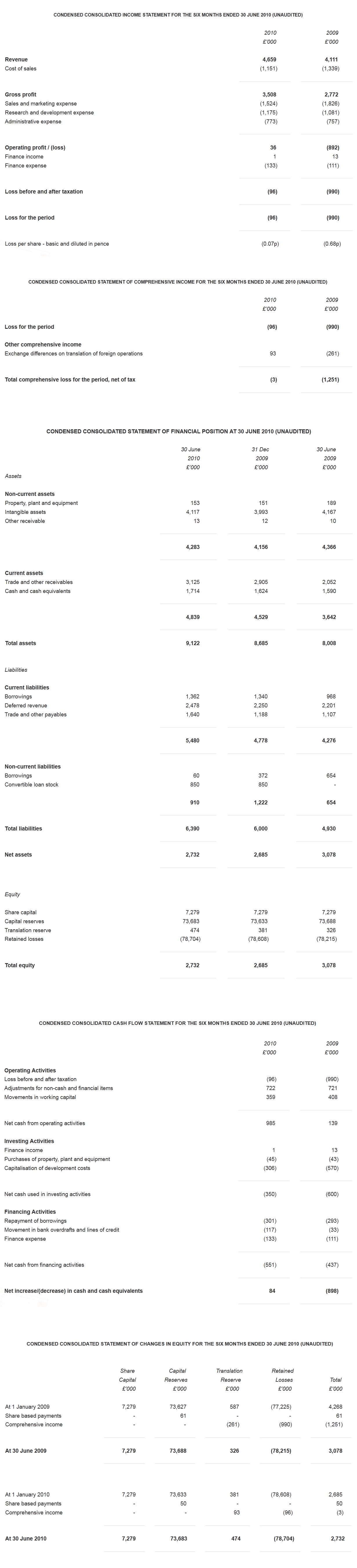

Revenue: £4.7m (2009: £4.1m)

EBITDA profit: £0.6m (2009: EBITDA loss £0.3m)

Loss before tax: £0.1m (2009: Loss £1.0m) -

Twenty-four license transactions completed including extension sales.

-

Revenue visibility for full-year 2010 now stands at £8.2m. This is up

from £6.0m reported in mid-June at the Company’s Annual General Meeting

and almost equals Sopheon’s total revenues for the full year 2009 which was £8.3m. -

The licensee base now stands at 178.

-

Cash at 30 June stood at £1.7m.

-

Launched www.isustain.com in partnership with Cytec Industries and the

Beyond Benign Foundation, a site that enables users to assess the sustainability

of product formulations through an iSUSTAIN Green Chemistry Index rating.

Sopheon’s Chairman, Barry Mence said: “We are delighted to report much-improved results with revenues up and costs down. After some very tough spending adjustments taken in 2009, it is also gratifying to see a return to growth and such strong improvement in our bottom line performance. Our expanded solution introduced in 2009 is generating increased sales both from our client base and new clients. Revenue visibility for the full year is already close to last year’s total revenues with four months of selling to go.”

Chairman's Statement

Trading Performance

After a tough year in 2009 consolidated revenues for the first half of 2010 were £4.7m, compared to £4.1m for the same period last year and £4.3m in the first half of 2008. Both new and existing customers made material license commitments. This resulted in an overall revenue mix among license, services and maintenance amounting to 36:27:37 respectively, compared to 30:26:44 during the first half of 2009.

Sales performance during the six-month period included 24 new and extension license orders, up from 17 the year before. The Company also added a number of consultancy and services contracts. In 2009, market conditions contributed to customer terminations of some maintenance, hosting and rental contracts. As a result, we entered 2010 with a recurring revenue base of £3.7m. At mid-year point, our recurring base has increased to £3.9m as new sales offset a small number of terminations. Revenue visibility has improved to £8.2m compared to £6.0m at the time of our Annual General Meeting in June.

The level of continued commercial activity is very encouraging. Our sales pipelines for the third quarter and beyond are healthy and are expected to drive additional increases in revenue visibility between now and the end of the year. Nevertheless, wider market conditions are still uncertain. As we have noted in our previous announcements, predicting the timing and value of individual sales is challenging, and this can consequently impact on revenue performance in a particular period.

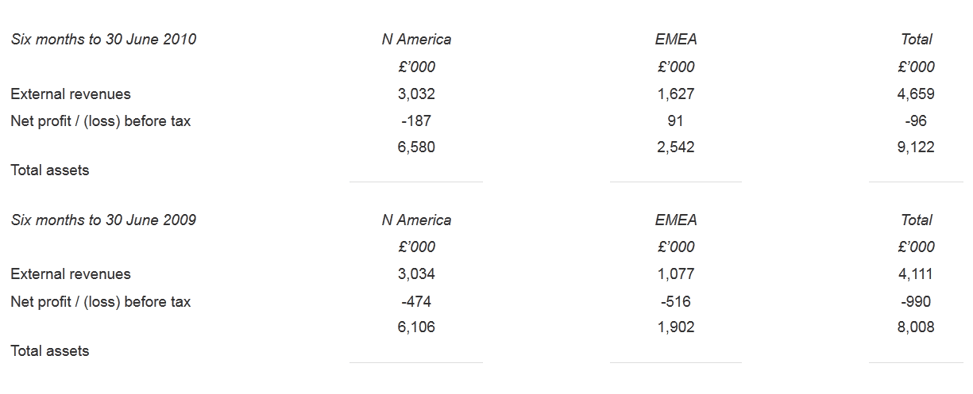

Approximately 60% of revenues during the first half of the year were generated by US operations, with the balance predominantly from Europe. This distribution is generally consistent with prior periods. The Alignent solution acquired in June 2007 accounted for 9% of total revenues recorded in the first half of 2010 compared to 11% in 2009 as a whole. Gross profit, which is arrived at after charging direct costs such as payroll for client services staff, was £3.5m. That compares to £2.8m for the same period in 2009, representing a rise in gross margin percentage from 67% to 75%. We expect the gross margin percentage to continue to fluctuate from period to period, in line with variation in our revenue mix.

Operating Costs and Results

Due to the headcount adjustments made last year, our cost base has changed. Total staff count at the start of 2009 was 105. During the year, we reduced staffing to 100 at the end of June, and then again to 84 by the end of December. This has remained the same for the first half of 2010. All areas of the business were affected, but as noted in previous announcements, we did not make reductions in product development until late 2009 in order to continue investment in expanding the breadth and reach of our solutions, as described later in this report. Looking ahead, if market conditions continue to improve, we will consider modest new recruitment and subcontracting activity in our product development and professional services teams before the end of the year.

The overall operating result for the business during the period was a profit of £36,000 (2009: loss of £892,000). After net finance costs, which include interest on debt taken on to finance the Alignent acquisition, the final loss before tax reported for the period is £96,000 (2009: loss of £990,000). This result includes interest, depreciation and amortisation costs amounting to £679,000 (2009: £658,000). The EBITDA result for the first half of 2010, which does not include these elements, was a profit of £583,000 (2009: loss of £330,000).

Corporate and Balance Sheet

Net assets at the end of the period stood at £2.7m (2009: £3.1m). Cash resources at 30 June 2010 amounted to £1.7m (2009: £1.6m). Approximately £0.5m was held in US dollars, £0.8m in Euros and £0.4m in Sterling.

Intangible assets at 30 June 2010 stood at £4.1m (2009: £4.2m). This includes (i) £2.5m being the net book value of capitalised research and development (2008: £2.3m) and (ii) £1.6m (2008: £1.9m) being the net book value of Alignent intangible assets acquired in 2007.

As part of the funding raised for the Alignent acquisition, Sopheon secured $3.5m of medium-term debt from BlueCrest Capital Finance LLC (“BlueCrest”). The debt is being repaid in 48 equal monthly instalments and is secured by a debenture and guarantee from Sopheon plc. BlueCrest also offered the enlarged Group an additional revolving credit facility secured on accounts receivable. This has been renewed through June 2011 with a facility limit of $1.25m. At 30 June 2010, the balances outstanding on the medium-term debt and revolving credit facility were $1.1m (2009: $2.0m) and $1.0m respectively (2009: $0.7m). The equivalent figures in Sterling are £0.7m (2009: £1.2m) and £0.7m (2009: £0.4m) respectively.

Market and Product

Major analyst organisations such as Forrester and Gartner see deepening traction and expanding opportunity particularly in Sopheon’s segment of the PPM market. In December 2009, Forrester noted increasing interest and investment in project and portfolio management tools for product development (PPM) and in the same month Gartner noted that software that supports product strategy and planning is gaining attention from prospective manufacturing end-users. Forrester also identified Sopheon as one of the clear market share leaders in the PPM space. From a vertical market standpoint, we continued to see good results during the period in our original key markets of chemicals, food and beverage, and consumer products. Activity during the period also provided further evidence that we are making significant inroads into the aerospace, defence and high technology markets.

We entered 2010 having devoted considerable investment and effort to product development during the preceding year. Tangible results included: the launch of Accolade® Idea Lab™, the first integrated solution that both facilitates generation and development of ideas, and enables those ideas to be moved seamlessly into product development; the release of a major new version of our Accolade Vision Strategist™ strategic product planning software; significant changes to our core Accolade Process Manager™ software that deepen its differentiation and value proposition; and most recently, the launch of the www.isustain.com green chemistry website in partnership with Cytec Industries Inc and the Beyond Benign Foundation. The site enables users to assess the sustainability of product formulations through an iSUSTAIN Green Chemistry Index rating. Users that wish to migrate beyond a basic level of interaction with the site are required to enter into paid-for subscriptions. In conjunction with these product and service advancements, we invested in new marketing capabilities that leverage emerging channels such as social media. We have also been working hard to improve the strength of our partner relationships, both at the reseller level and at the strategic level.

Outlook

Our decision to maintain investment in product development during the difficult months of early 2009 has yielded important competitive advantages and business benefits. We have also continued to invest in marketing and partner initiatives which, along with the product investments, have contributed to further strengthening our strategic position. Sopheon offers the only software suite in the industry to provide all-in-one support that encompasses innovation strategy, ideation and execution. This highly differentiated value proposition has been affirmed by our customers and by the business analyst community.

The market is responding favorably to new enhancements to our products. Our sales pipeline continues to show encouraging levels of activity that we believe indicate a resurgent focus amongst large corporations on product innovation as a strategic priority. As always, the challenge is to convert this activity into signed contracts. Nevertheless, full year revenue visibility for 2010 at £8.2m already stands close to the 2009 full year performance of £8.3m. A return to growth will also drive the need for additional resources to deliver our solutions and services. As noted earlier in this report, we will consider careful expansion in resources to meet this requirement, during the second half of the year.

After a difficult time in 2009, including some very tough spending adjustments, it is gratifying to see a return to growth and such a strong improvement in our bottom line performance. We look to the future with renewed confidence.

| Barry Mence Chairman |

26 August 2010 |

Visibility

Trademarks

Cautionary Statement

Notes To The Financial Statements

1. General information

Sopheon Plc (the "Company") is a company domiciled in England. The condensed consolidated interim financial statements of the Company for the six months ended 30 June 2010 comprise the Company and its subsidiaries (together referred to as the "Group").

2. Accounting policies

Basis of preparation

These condensed consolidated financial statements have been prepared in accordance with IAS 34 "Interim Financial Reporting", as adopted by the European Union. They do not include all disclosures that would otherwise be required in a complete set of financial statements and should be read in conjunction with the 2009 Annual Report. The financial information for the half years ended 30 June 2010 and 30 June 2009 does not constitute statutory accounts within the meaning of Section 434(3) of the Companies Act 2006 and is unaudited.

The annual financial statements of Sopheon Plc are prepared in accordance with IFRSs as adopted by the European Union. The comparative financial information for the year ended 31 December 2009 included within this report does not constitute the full statutory accounts for that period. The statutory Annual Report and Financial Statements for 2009 have been filed with the Registrar of Companies. The Independent Auditors' Report on that Annual Report and Financial Statement for 2009 was unqualified, but consistent with prior years, drew attention to an emphasis of matter due to uncertainty over going concern and did not contain a statement under 498(2) or 498(3) of the Companies Act 2006.

Going concern

The half year financial information has been prepared on a going concern basis. In reaching their assessment, the directors have considered a period extending at least 12 months from the date of approval of this information and have considered both the forecast performance for the next 12 months and the cash and financing facilities available to the Group.

In the first half of 2010, the Group achieved revenues of £4.7m and incurred a loss of £0.1m. This represents a much improved performance compared to the previous year. The Group’s sales pipeline remains very active, and accordingly, the directors remain positive about the prospects for the business. However, the time-to-close and the order value of individual sales can vary considerably, factors which constrain the ability to accurately predict short term revenue performance. There is also continued evidence of customers taking longer to pay amounts owed to the Group.

The Group has a loan note from BlueCrest Capital Finance (“BlueCrest”) which is repayable in equal monthly instalments of $91,000 through July 2011. The balance remaining due on the note at 30 June 2010 was $1,104,000 (£738,000). The Group also has access to a $1,250,000 revolving line of credit with BlueCrest which is secured against the trade receivables of Sopheon’s North American business. This was renewed for an additional 12 month period through 30 June 2011. At 30 June 2010, $1,040,000 (£695,000) was drawn against this revolving facility. In addition, the Group has received a convertible loan of £850,000, repayable or convertible by 30 September 2011. At 30 June 2010, the Group reported net assets of £2.7m and cash resources of £1.7m.

If sales fall short of expectations, or if the Group’s existing facilities prove insufficient, the Group may need to raise additional finance. The Group continues to have access to the debt and equity markets, and the directors have demonstrated the ability to raise funds during the previous year. In addition, the Group has access to an equity line of credit facility from GEM Global Yield Fund Limited (“GEM”) for an aggregate of €10m, the current term of which expires in December 2011. GEM’s obligation to subscribe for shares is subject to certain conditions linked to the prevailing trading volumes and prices of Sopheon shares on the Euronext stock exchange. To date Sopheon has made one call on the equity line of credit facility in March 2004, leaving a maximum €9m potentially available.

The directors have concluded that the circumstances set forth above represent material uncertainties, however they believe that taken as a whole, the factors described above enable the Group to continue as a going concern for the foreseeable future. The financial information does not include the adjustments that would be required if the Company or Group were unable to continue as a going concern.

Changes in accounting policies

The same accounting policies, presentation and methods of computation are followed in these condensed consolidated financial statements as were applied in the Group's latest annual audited financial statements.

A number of IFRS and IFRIC amendments or interpretations have become effective since the last annual report but none of these have had a material impact on the Group's reporting.

3. Segmental Analysis

All of the Group’s revenues in respect of the six month periods ended 30 June 2010 and 2009 derived from the design, development and marketing of software products with associated implementation and consultancy services. For management purposes, the Group is organised across two principal operating segments, which can be expressed geographically. This basis is the same as that used in the Company’s last annual financial statements. The first segment is North America, and the second EMEA (Europe, Middle East and Africa). Information relating to these two segments is given below. All information provides analysis by location of operations.

4. Earnings Per Share

The calculation of basic earnings per ordinary share is based on a loss of £96,000 (2009 – loss of £990,000) and on 145,579,027 ordinary shares (2009 – 145,579,027) being the weighted average number of ordinary shares in issue during the year. The diluted loss per ordinary share for both 2010 and 2009 are the same as the basic loss per ordinary share in each year, because the exercise of share options would have the effect of reducing the loss per ordinary share and was therefore not dilutive.

5. Intangible Assets

In accordance with IAS 38 Intangible Assets, certain development expenditure must be capitalised and amortised based on detailed technical criteria, rather than automatically charging such costs in the income statement as they arise. This has led to the capitalisation of £306,000 (2009: £570,000), and amortisation of £363,000 (2009: £330,000) during the period. In addition, amortisation of £130,000 (2009: £170,000) has been charged during the period against the intangible assets originally acquired with Alignent, in June 2007.

6. Related Party Transactions

There were no related party transactions required to be disclosed in any period. Transactions between the company and its subsidiary undertakings, which are related parties, have been eliminated on consolidation and are not disclosed in this note.

7. Principal Risks and Uncertainties

There are a number of potential risks and uncertainties which could have a material impact on the Group's performance over the remaining six months of the financial year and could cause actual results to differ materially from expected and historical results. The directors do not consider that the principal risks and uncertainties have changed since the publication of the annual report for the year ended 31 December 2009. The continuing uncertainty in the global economic outlook inevitably increases the trading and balance sheet risks to which the Group is exposed. Other principal risks and uncertainties of the Group for the remaining six months of the current financial year are disclosed in the Chairman’s Statement and the notes to the condensed set of financial statements included in this half yearly report. A more detailed explanation of the risks relevant to the group is on page 18 of the annual report which is available at www.sopheon.com.

8. Statement of Directors Responsibilities

The Directors confirm to the best of their knowledge:

-

The unaudited condensed set of financial statements has been prepared in accordance with IAS

34 "Interim Financial Reporting" as adopted by the EU; and -

The interim management report includes a fair review of the information required by DTR

4.2.7R and DTR 4.2.8R of the Disclosure and Transparency Rules of the UK Financial Services Authority.

| On behalf of the Board | 26 August 2010 | |

| Barry Mence | Andy Michuda | Arif Karimjee |

| Chairman | Chief Executive Officer | Chief Financial Officer |

Independent Review Report To Sopheon PLC

Introduction

We have been engaged by the Company to review the condensed set of financial statements in the half-yearly financial report for the six months ended 30 June 2010 which comprises the condensed consolidated income statement; condensed consolidated statement of comprehensive income; condensed consolidated statement of financial position; condensed consolidated cash flow statement; condensed consolidated statement of changes in equity; and associated notes. We have read the other information contained in the half-yearly financial report and considered whether it contains any apparent misstatements or material inconsistencies with the information in the condensed set of financial statements.

Directors’ responsibilities

The interim report, including the financial information contained therein, is the responsibility of and has been approved by the directors. The directors are responsible for preparing the interim report in accordance with the rules of both the London Stock Exchange for companies trading securities on the Alternative Investment Market and Euronext Amsterdam which require that the half-yearly report be presented and prepared in a form consistent with that which will be adopted in the Company's annual accounts having regard to the accounting standards applicable to such annual accounts.

Our responsibility

Our responsibility is to express to the Company a conclusion on the condensed set of financial statements in the half-yearly financial report based on our review. Our report has been prepared in accordance with the terms of our engagement to assist the Company in meeting the requirements of the rules of both the London Stock Exchange for companies trading securities on the Alternative Investment Market and Euronext Amsterdam and for no other purpose. No person is entitled to rely on this report unless such a person is a person entitled to rely upon this report by virtue of and for the purpose of our terms of engagement or has been expressly authorised to do so by our prior written consent. Save as above, we do not accept responsibility for this report to any other person or for any other purpose and we hereby expressly disclaim any and all such liability.

Scope of review

We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410, ‘‘Review of Interim Financial Information Performed by the Independent Auditor of the Entity’’, issued by the Auditing Practices Board for use in the United Kingdom. A review of interim financial information consists of making enquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing (UK and Ireland) and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the condensed set of financial statements in the half-yearly financial report for the six months ended 30 June 2010 is not prepared, in all material respects, in accordance with the rules of the London Stock Exchange for companies trading securities on the Alternative Investment Market and for the rules governing listed securities on Euronext Amsterdam.

Emphasis of Matter - Going concern

In arriving at our review conclusion, we have considered the adequacy of the disclosures made in Note 2 regarding the Group's ability to continue as a going concern. As in prior periods, these disclosures identify certain factors that indicate the existence of material uncertainties which may cast a significant doubt over the Group’s ability to continue as a going concern. As discussed in Note 2, the appropriateness of the going concern basis remains reliant on the Group achieving an adequate level of sales in order to maintain sufficient working capital to support its activities, or if this objective is not met, being able to raise sufficient additional finance. The financial statements do not include the adjustments that would result if the group were unable to continue as a going concern.

BDO LLP

Chartered Accountants & Registered Auditors, London

26 August 2010