Sopheon plc, the international provider of software and services that improve the financial return from innovation and product development investments, announces its results for the year ended 31 December 2010 together with an outlook for the current year.

Highlights:

-

Revenue for the year was ahead of market expectations at £10.5m (2009: £8.3m). Full year revenue visibility for 2011 already stands at £5.2m, compared to £4.8m at the same time last year.

-

EBITDA for the year was also ahead of market expectations at £1.5m (2009: loss £0.2m).

-

Recurring revenue base coming into 2011 grew to £3.9m from £3.7m coming into 2010.

-

58 new and extension license orders secured during the year.

-

New customers contributed 38% (2009: 27%) of non-recurring sales during the year.

-

Achieved a major improvement to our working capital position by negotiating changes to the maturity profile of the Group’s convertible loan stock, and the introduction of $2.7m of additional working capital from our existing corporate lenders. Cash at year end stood at £3.4m (2009: £1.6m).

Barry Mence, Chairman, commented: “We are very pleased to show notable improvement in our performance during 2010. It is not yet clear that the effects of the global crisis on our markets are fully behind us, but we are encouraged by early indications for the coming year. We are entering 2011 with both the strategic and the financial strength to move forward with confidence and optimism.”

For Futher Information Contact:

| Barry Mence, Chairman | Sopheon plc | Tel : + 44 (0) 1483 685 735 |

| Arif Karimjee, CFO | Sopheon plc | Tel : + 44 (0) 1483 685 735 |

| Charles Cunningham / Charlotte Stranner / Joanna Weaving | finnCap | Tel : + 44 (0) 20 7600 1658 |

| Nicholas Nelson / Guy McDougall | Hansard (Financial PR) | Tel : + 44 (0) 20 7245 1100 |

| Claire Verhagen | Citigate First Financial | Tel : + 31 (0) 205 754 010 |

About Sopheon

Sopheon (LSE: SPE) is an international provider of software and services that help organisations improve the business impact of product innovation. Sopheon's solutions automate and govern the innovation process, enabling companies to increase revenue and profits from new products. Sopheon's solutions are used by industry leaders throughout the world, including BAE Systems, BASF, Corning, Electrolux, Honeywell, Novartis and SABMiller. Sopheon is listed on the AIM Market of the London Stock Exchange and on the Euronext in the Netherlands.

Accolade®, Vision Strategist tm Idea Lab tm and Process Manager tm are trademarks of Sopheon.

Revenue visibility is defined in Note 7.

Chairman's Statement

Trading Performance

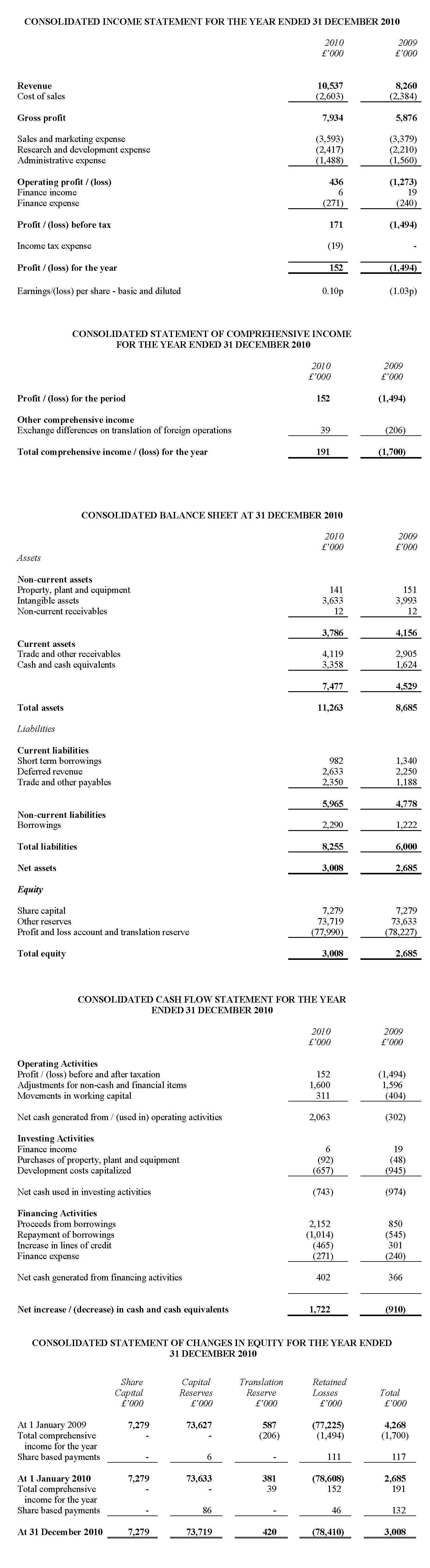

We are delighted to report strong growth in 2010. Revenues were £10.5m, up from £8.3m in 2009, and Sopheon also delivered a major improvement in profitability. The EBITDA result was a profit of £1.5m compared to a £0.2m loss in 2009. We are also very pleased to report a positive bottom line profit after tax of £152,000 (2009: £1.5m loss).

Total license transactions including extension orders were 58 in 2010 (2009: 48) and license income rose to more than 37% of revenue (2009: 32%). The relative contribution of the North American market fell slightly to 66% of revenues from 69% in 2009, with the EMEA markets making up the remaining 34% (2009: 31%). In spite of the overall strong financial results, we look forward to improvements in other business areas in the coming year. Accolade® Vision Strategist™ contributed approximately 9% of total revenues in 2010, compared to 12% in 2009. We believe our continued investment and integration of this solution into Sopheon’s core value proposition will result in improved performance for Vision Strategist in 2011. Our reseller partners had a tough year, attributed to challenges in their local economies, and accounted for 5% of revenues, down from 9% the year before. An improved 2011 is forecasted across the reseller community.

At the date of this report, full-year 2011 revenue visibility incorporating booked revenue, contracted services business and the run rate of recurring contracts already stands at £5.2m, compared to £4.8m at the same time last year. Revenue visibility is more fully defined in Note 7.

Trading Performance

Sopheon’s consolidated turnover in 2010 increased by 27% to £10.5m compared to £8.3m in 2009. Revenues from both North American and EMEA territories showed significant improvement, with the latter somewhat stronger; as a proportion of the total, revenues from EMEA customers rose to 34% from 31% the year before. Unlike previous years, Sterling was relatively stable against Dollar and Euro during 2010 and currency factors did not play a material role in income statement development.

Total license transactions including extension orders were 58 in 2010 compared to 48 in 2009, an increase of 20%. License transactions included 8 relating to the Vision Strategist solution, acquired with the Alignent business in 2007. Overall, Vision Strategist contributed approximately 9% of total revenues during 2010 compared to 12% in 2009. Our new Accolade Idea Lab™ solution contributed 3% of revenues. In addition to the volume improvement, we also benefited from a number of very substantial individual orders. This in conjunction with the volume improvement led to the financial performance in the fourth quarter of 2010 being the strongest of the year.

Business Mix

The annualized average growth of the business since the launch of Accolade is just over 28%. However, within this overall picture license and services revenues grew substantially, chalking up increases of 50% and 47% respectively. These impressive results were offset by a flat revenue performance in maintenance revenues. During 2009, and to a lesser extent in 2010, certain customers reacted to economic uncertainty with reorganization and rationalization, which resulted in terminations of maintenance and rental contracts. Nevertheless, when offset by new orders received, the base of recurring revenue grew from £3.7m coming into 2010, to £3.9m coming into 2011. The majority of this income is represented by maintenance services, but also includes hosting services and license rentals.

Overall, in 2010 our business delivered a 37:34:29 ratio of license, maintenance, service respectively compared to 32:42:26 in the prior year. These statistics reflect the strong growth in orders for license and services as compared to recurring maintenance and hosting revenues.

As noted above, in addition to the increase in order volumes year over year, the average value of each transaction rose, further increasing the contribution from new orders as compared to recurring revenue. 62% of the value of these new orders in 2010 was derived from our existing customers, compared to 73% in 2009. This shift is explained by a rise in new client acquisition, demonstrating the relevance of Sopheon’s solutions to the needs of industry in today’s economy. At the same time, the fact that add-on business from existing customers remains relatively high, underlines both the inherent value of our solutions, and the extended business opportunity for Sopheon from each new customer we sign. As further reinforcement of this point, analysis of our top customers over the last 5 years, demonstrates 20 customers with cumulative revenues in excess of $1m, of which 10 are in excess of $2m.

Overall gross margins have risen to 75% (2009: 71%) which can be largely attributed to the return of license and service revenues, with only a relatively modest rise in associated costs of delivery. Within this overall picture, we did incur approximately £0.2m of third party software costs; as we noted in our 2009 report, we anticipated that license margins would be slightly affected by decisions to embed, rather than build, certain third party components or methods of working into our software. This is expected to continue going forward. Our professional services costs remained broadly stable overall, however as communicated in our 2009 report, our decision to hold on hiring in favor of a subcontracting model last year has resulted in a fall in fixed salaries of around £0.3m, offset by a rise in bonuses, subcontractor fees and other variable costs. We expect this balance to shift back towards permanent resources in 2011.

Research & Development Expenditure

As noted above, we sustained investment in product development during the course of 2009 with a view to maintaining our goal of continued product leadership. This resulted in multiple product launches and enhancements that year. We did however make some reductions towards the end of 2009, leading to a lower fixed cost in 2010; budgets for development were then held through 2010, and then gradually released in the final quarter of the year.

Overall, including provision for bonuses, the actual expenditure in research and development declined very slightly year over year. However, headline research and development expenditure reported in the income statement rose by 9% from £2.2m to £2.4m. This apparent increase of £0.2m (2009: £0.1m reduction) is attributable to the net impact of capitalization, amortization and impairment charges associated with research and development. The amount of 2010 research and development expenditure that met the criteria of IAS 38 for capitalization was £0.7m (2009: £0.9m).

Sopheon is committed to product leadership with excellence in research and development a core competency of the group; since 2001 Sopheon’s reported research and development costs each year have been at least 20% of revenues reported in that year. For 2010, this metric was 23% (2009: 27%).

Operating Costs

Of relevance to all aspects of the income statement is the fact that the strong performance in 2010 has led to a maximum bonus award being made to all members of the company who are on the corporate bonus scheme. This covers the majority of the group’s executives and employees, with the principal exception of the sales teams for whom incentives are tied to individual or territory results. The costs of the bonus have been allocated to the relevant categories of the income statement.

Overall staff costs have increased by £0.1m. The apparent increase is entirely due to the impact of bonuses and higher commissions, offset by the reduction in average staff levels from 99 to 84, between 2009 and 2010.

Detailed comments regarding professional services and research and development costs are noted above. Headline sales and marketing costs have risen from £3.4m in 2009 to £3.6m in 2010. As with professional services and research and development, actual fixed costs fell year on year but this was offset by higher commissions and the incidence of bonus costs, as well as a higher amortization and impairment charges for the intangible customer assets acquired with Alignent in 2007. Average headcount in sales and marketing remained relatively constant through the year.

Headline administration costs have fallen by less than £0.1m. Much of the fall can be attributed to reductions in accounting costs such as exchange losses and recognition of share based payments. Total underlying administration costs and resourcing have remained broadly constant, as they have since 2007. With this total there have been a number of movements, for example rent and insurance costs are down, whereas professional fees and information technology costs have risen. Such costs will continue to be managed tightly as the group expands operational resources.

Results

The combined effect of the revenue and cost performance discussed above has resulted in Sopheon’s EBITDA performance for 2010 rising to £1.5m, from a loss of £0.2m in 2009.

In common with other businesses in our sector, Sopheon measures its annual performance using EBITDA (Earnings before Interest, Tax, Depreciation and Amortization) which the board believes provides a useful indicator of the operating performance of our business by removing the effect on earnings of tax, capital spend and financing. EBITDA is further defined and reconciled to the profit before tax in Note 6. Our calculation of EBITDA is stated after charging (i) share based payments of £0.1m (2009: £0.1m); (ii) impairment charges of acquired intangible assets of £0.2m (2009: £0.2m); and (iii) exchange losses of £7,000 (2009: £31,000) but excludes depreciation and amortization charges for the year of £1.1m (2009: £1.1m) and net finance costs of £0.3m (2009: £0.2m).

Including the effect of interest, depreciation and amortization, the group reported a profit before tax for the year of £171,000 (2009: £1.5m loss). Tax has been provided at £19,000, representing US Alternative Minimum Tax chargeable on US profits (2009: £nil). This reduces the retained profit after tax to £152,000 (2009: £1.5m loss). The profit per ordinary share was 0.10p (2009: 1.03p loss).

In addition to the turn-around in profitability, in 2010 Sopheon also delivered a sharp improvement in cash flow generation. After deducting investment costs, the group generated cash of £1.3m compared to cash usage of £1.3m in 2009.

Financing and Balance Sheet

Consolidated net assets at the end of the year stood at £3.0m (2009: £2.7m). Gross cash resources at 31 December 2010 amounted to £3.4m (2009: £1.6m). Approximately £2.1m was held in US Dollars, £1.0m in Euros and £0.4m in Sterling.

Intangible assets stood at £3.6m (2009: £4.0m) at the end of the year. This includes (i) £2.4m being the net book value of capitalized research and development (2009: £2.4m) and (ii) an additional £1.2m (2009: £1.6m) being the net book value of Alignent intangible assets acquired in 2007. The apparently constant level of the capitalized research and development, disguises a capitalization value roughly equal to the amortization charged in respect of these assets. The carrying value of the Alignent intangibles has been impacted by both amortization and impairment charges. Further details are set forth in Note 11.

In June 2007, the group entered into a $3.5m, 48-month mezzanine term loan with BlueCrest Capital Finance (“BlueCrest”), in connection with its acquisition of Alignent Software Inc. This term loan was repayable in equal monthly instalments through to July 2011. On 8 December 2010 the Company signed an agreement with BlueCrest to refresh the mezzanine term loan back up to $3.5m, for a new 39-month term, repayable in equal monthly instalments of $90,000 plus interest through March 2014. The loan bears interest at 13% per annum and incurs a facility fee of 3.75%. After expenses and deducting the carrying value of the original loan, this transaction brought a net cash injection of $2.7m to the Group. No warrants were issued to BlueCrest in connection with the transaction.

In addition to the term loan, for a number of years the group has had access to a revolving line of credit with BlueCrest, secured against the trade receivables of Sopheon’s North American business and with a maximum draw capacity of $1.25m. This facility was renewable annually on 30 June, but in conjunction with the changes to the term loan, the next renewal date for the facility has been extended to 30 November 2011.

In October 2009, the Company issued £850,000 of convertible unsecured loan stock to a group of investors including key members of the Board and senior management team, maturing on 2 October 2011. On 8 December 2010, the holders of the loan stock unanimously agreed to extend the maturity date of the loan stock by sixteen months to 31 January 2013, and to remove the provision under which, if the Company undertook a placing or other issue of shares at a lower price per share than the conversion price, the conversion price would be adjusted to the placing price (the “Placing Provision”). This amendment was coupled with modification of the conversion price of the loan stock to 7.75p per share, being the current market price, from 10p per share. These changes improved the net current asset and the net asset position of the group, while also removing a potential source of income statement volatility linked to the accounting treatment of the Placing Provision under the rules of IAS 39.

In accordance with the AIM Rules for Companies, Daniel Metzger, having consulted with the Company’s Nominated Adviser, acted as independent director with respect to this transaction and considered that the amendment to the terms of the convertible loan stock were fair and reasonable insofar as the Company’s shareholders are concerned.

Sopheon’s equity line of credit facility with GEM Global Yield Fund Limited ("GEM") was due to expire on 23 December 2009. During the year, GEM agreed to implement a further two year extension at no cost to Sopheon, through to 23 December 2011. The facility has been used to raise working capital once, in March 2004, leaving approximately 90% of the original €10m facility available under the extended agreement. Drawings under the GEM equity line of credit are subject to conditions relating inter alia to trading volumes in Sopheon shares.

Markets & Products

We entered 2010 having devoted considerable investment and effort to product development during the preceding year of 2009. Tangible results included the launch of Accolade® Idea Lab™ , the first solution that both facilitates generation and development of ideas, and enables those ideas to be moved seamlessly through the product development life cycle; the release of a new version of our Accolade Vision Strategist™ strategic product planning software; and continued investment in our core Accolade Process Manager™ software.. During 2010, we continued investment in all three areas. Outcomes included a further release of Vision Strategist, and a soft release of a new module that enables companies to dynamically balance resource and portfolio requirements. We also launched www.isustain.com, a website that enables users to assess the sustainability of product formulations using green chemistry principles, in partnership with Cytec Industries Inc and the Beyond Benign Foundation.

We continue to see good results in our original key markets of chemicals, food and beverage, and consumer products. Activity during 2010 also provides further evidence of progress in the aerospace, defense and high technology markets. As noted above, our reseller partners had a relatively difficult 2010, but we are encouraged by a renewed sense of optimism among our partner community. In this regard, we were pleased to welcome representatives from seven partners to our recent internal global sales conference. We continue to believe that developing our reseller and consulting partner network is key to our future growth ambitions.

In the aftermath of the global economic crisis, many companies are once again focusing their attention on growth, and innovation is returning to the forefront as a strategic priority. Eighty-four percent of the senior corporate executives participating in a recent global survey by McKinsey & Company stated that innovation is extremely or very important to their companies’ growth strategy. Principal challenges listed by McKinsey included integrating innovation with strategic planning, selecting the right product ideas to develop, and establishing a consistent process for bringing the best concepts to market. Sopheon’s solutions address these needs head-on. We are unique in offering an all-in-one software system that encompasses support for product strategy, ideation and product development process execution. We are energized by the strength of our market position, and by our potential for continued, substantial growth. Our decision to sustain internal product development investment, throughout the difficult economic period of 2009 and 2010, was a critical component of our strategy to build market share.

People

Sopheon continues to differentiate itself with the deep domain expertise our people have gained around innovation governance. This knowledge and experience has been created over many years from working with industry leading companies on this emerging business process. We are very proud of the commitment that our people have shown in achieving leadership in this area, and in maintaining it through the recent economic challenges.

Coming into 2011, we have taken steps to reorganize and strengthen Sopheon’s operational management team to position the company for growth. Our sales and services operations are now organized on a regional basis, with teams in the North America and EMEA, led by Mike Ducatelli and Gert Staal respectively. Mike, formerly with Lawson Software and PTC, has led Sopheon’s North American sales organization since 2007, and we are delighted he has taken responsibility for all field operations in the territory. Gert joined the group in January 2011. Based in Amsterdam, Gert is a former senior executive with Reed Elsevier and has extensive experience and connections in the product development arena. Don Sarno, VP of Product Development, recently joined Sopheon to lead our product development efforts through the next stages of company growth. Based in Denver, Don has experienced and played key roles in similar transformations at companies like Intuit Corporation prior to joining Sopheon.

The remainder of our leadership team remains unchanged. I serve on the team with fellow executive board directors, CEO Andy Michuda and CFO Arif Karimjee. Our CTO Paul Heller, and VP of research Huub Rutten, complete the group. Executive management is complemented by a strong operational management team that leads the marketing and services functions. The Sopheon plc board is made up of the three executive directors, augmented by three non-executive directors who bring a wealth of knowledge and experience to our business.

Outlook

The market has responded favourably to new enhancements of our products. Coming into 2011, we are encouraged by the strength of our sales pipeline, which is very active in particular in North America. We have taken steps to position Sopheon to take advantage of the improving business climate. This has involved controlled expansion of staff levels including new leadership in key areas, as noted above, and our full time headcount now stands at 95. At the end of 2009, we had a headcount of 85; we maintained staffing at this level through most of 2010. Cost controls were an important component of the sharp turnaround in profitability last year. Our plans for 2011 call for further staff expansion, but we will remain vigilant in matching costs to revenue expectations.

To facilitate confident execution of our strategy, and maintain the ability to react rapidly to new market opportunities, in December we effected a major improvement to our working capital position. This involved negotiating changes to the maturity profile of the Group’s convertible loan stock, and the introduction of $2.7m of additional working capital from our existing corporate lenders, BlueCrest Capital.

After a difficult 2009, which included taking some very tough spending adjustments, it is gratifying to see a return to growth and such a strong improvement in our bottom-line performance. We look to the future with renewed confidence.

| Barry Mence Chairman |

24 March 2011 |

The translation reserve represents accumulated differences on the translation of assets and liabilities of foreign operations. Retained losses represent accumulated trading losses, including amortisation and impairment charges in respect of goodwill and intangible assets arising from past acquisitions. Capital reserves represent share premium, merger reserve, capital redemption reserve and share options reserve.

1. Basis of Preparation

The financial information set out in this document does not constitute the company's statutory accounts for 2009 or 2010. Statutory accounts for the years ended 31 December 2009 and 31 December 2010 have been reported on by the Independent Auditors. The Independent Auditors' Reports on the Annual Report and Financial Statements for each of 2009 and 2010 were unqualified and did not contain a statement under 498(2) or 498(3) of the Companies Act 2006, but consistent with prior years, drew attention to an emphasis of matter due to the uncertainty over going concern.Statutory accounts for the year ended 31 December 2009 have been filed with the Registrar of Companies. The statutory accounts for the year ended 31 December 2010 will be delivered to the Registrar in due course and will be posted to shareholders shortly, and thereafter will be available from the Company's registered office at 40 Occam Road, Surrey Research Park, Guildford, Surrey, GU2 7YG and from the Company's website www.sopheon.com.

The financial information set out in these preliminary results has been prepared using the recognition and measurement principles of International Accounting Standards, International Financial Reporting Standards and Interpretations adopted for use in the European Union (collectively Adopted IFRSs). The accounting policies adopted in these preliminary results have been consistently applied to all the years presented and are consistent with the policies used in the preparation of the statutory accounts for the period ended 31 December 2010. The principal accounting policies adopted are unchanged from those used in the preparation of the statutory accounts for the period ended 31 December 2009. New standards, amendments and interpretations to existing standards, which have been adopted by the group have not been listed, since they have no material impact on the financial statements.

2. Going Concern

The financial statements have been prepared on a going concern basis. In reaching their assessment, the directors have considered a period extending at least 12 months from the date of approval of these financial statements. This assessment has included consideration of the forecast performance of the business for the foreseeable future, the cash and financing facilities available to the group, and the repayment terms in respect of the group’s borrowings, including the potential of having to repay convertible loan stock in January 2013.

During 2010, the group achieved revenues of £10.5m and a profit before tax of £171,000. This represents an improvement over the previous year. The performance in 2009 was itself weaker than that achieved in 2008, which the directors attribute to the weakening of global economic conditions at the time. Coming into 2011, the group’s sales pipeline remains very active, and accordingly, the directors remain positive about the prospects for the business.

In December 2010 the group renegotiated its loan note from BlueCrest Capital Finance (“BlueCrest”) for a new principal value of $3.5m, which brought in new working capital of approximately $2.7m. The principal is repayable in equal monthly instalments of $90,000, plus interest, through March 2014. The group also has access to a revolving line of credit with BlueCrest which is secured against the trade receivables of Sopheon’s North American business. This facility is renewable annually and the current term is to 30 November 2011. The facility limit is $1,250,000. At 31 December 2010, $500,000 (£318,000) was drawn against this revolving facility. In addition, during 2009 the group had secured a convertible loan for £850,000, repayable or convertible by 30 September 2011. In December 2010, the term of this loan was extended to 31 January 2013.

Notwithstanding the group’s much improved funding and trading position, the time-to-close and the order value of individual sales continues to vary considerably. When combined with the relatively low-volume and high-value nature of the group’s business, these are factors which constrain the ability to accurately predict revenue performance. In addition, to meet its strategic objectives, the group is expanding staff. If sales fall short of expectations, there is a risk that the group’s facilities may prove insufficient to cover both operating activities and the repayment of its debt facilities, being on the one hand the regular repayment of the BlueCrest term loan and on the other hand, the possibility of having to repay in cash £850,000 of convertible loan stock on 31 January 2013. In such circumstances, the group would be obliged to seek additional funding.

The directors have concluded that the circumstances set forth above represent material uncertainties, which may cast significant doubt about the group’s ability to continue as a going concern, however they believe that taken as a whole, the factors described above enable the group to continue as a going concern for the foreseeable future. The financial statements do not include the adjustments that would be required if the company or group were unable to continue as a going concern.

3. Director’s Responsibility Statement

The responsibility statement set out below has been reproduced from the Annual Report and Accounts, which will be published in March 2011, and relates to that document and not this announcement:The annual report is the responsibility of, and has been approved by, the directors. The directors confirm to the best of their knowledge that:

-

The financial statements, prepared in accordance with International Financial Reporting Standards as endorsed by the European Union and Article 4 of the IAS regulation, give a true and fair view of the assets, liabilities, financial position and profit or loss of the issuer and the undertakings included in the consolidation taken as a whole; and

-

The annual report includes a fair review of the development and performance of the business and the position of the issuer and the undertakings included in the consolidation taken as a whole, together with a description of the principal risks and uncertainties that they face.

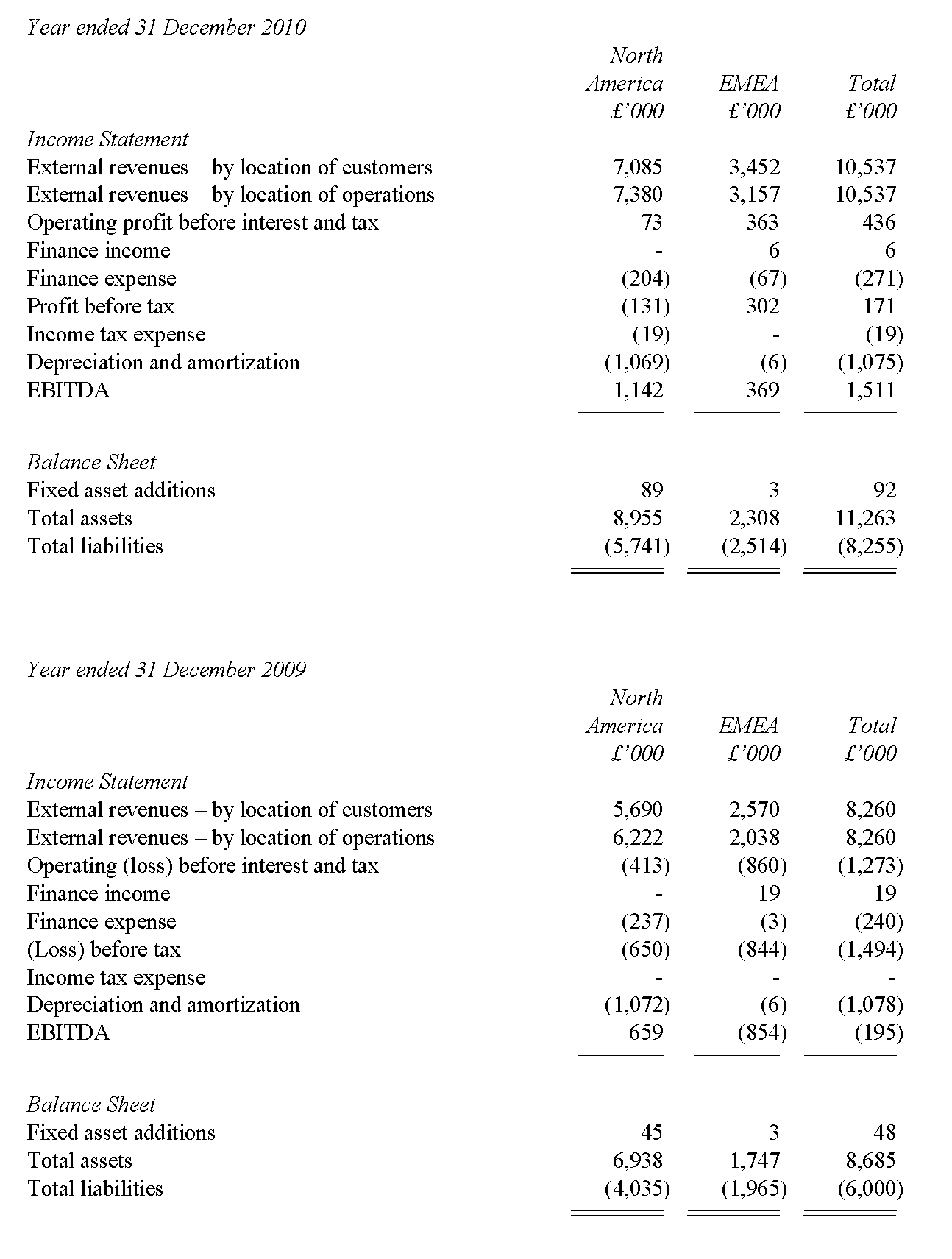

4. Segmental Analysis

All of the group’s revenue in respect of the years ended 31 December 2010 and 2009 derived from the design, development and marketing of software products with associated implementation and consultancy services, as more particularly described in the Directors’ Report. For management purposes, the group is organized geographically across two principal operating segments, which can be expressed geographically. The first segment is North America, and the second Europe, Middle East and Africa. Information relating to these two segments is given below.

The information in the following table relating to external revenues includes analysis both by location of customer and by location of operations. The information relating to other items provides analysis by location of operations only. Inter-segment revenues are priced on an arm’s length basis.

One customer, served by both segments, accounted for approximately 10 percent of the group’s revenues in 2010. No customer accounted for 10 percent or more of the group’s sales in 2009. External revenues exclude inter-segment royalty charges which amounted to £572,000 (2009: £472,000) for North America and £485,000 (£465,000) for EMEA. Revenues attributable to customers in the UK in 2010 amounted to £772,000 (2009: £1,268,000). The segmental analysis above has been presented using information that is readily available to management.

5. Revenue

All of the Group’s revenue in respect of the years ended 31 December 2010 and 2009 derived from continuing operations and from the design, development and marketing of software products with associated implementation and consultancy services.

6. EBITDA

The directors consider that EBITDA, which is defined as earnings/(loss) before interest, tax, depreciation and amortization, is an important measure, since it is widely used by the investment community. It is calculated by adding back depreciation and amortization charges amounting to £1,074,000 (2009: £1,078,000) to the operating profit of £436,000 (2009: operating loss of £1,273,000).

7. Revenue visibility.

Another performance indicator used by the group and referred to in narrative descriptions of the group’s performance is revenue visibility. At any point in time it comprises revenue expected from (i) closed license orders, including those which are contracted but conditional on acceptance decisions scheduled later in the year; (ii) contracted services business delivered or expected to be delivered in the year; and (iii) recurring maintenance, hosting and rental streams. The visibility calculation does not include revenues from new sales opportunities expected to close during the remainder of the year.

8. Share Based Payments

In accordance with IFRS2 Share based Payments, an option pricing model has been used to work out the fair value of share options granted since November 2002, with this being charged to the income statement over the expected vesting period and leading to a charge of £81,000 (2009: £117,000).

9. Income Tax

At 31 December 2010, tax losses estimated at £59m were available to carry forward by the Sopheon Group, arising from historic losses incurred. An aggregate £12m of these losses are subject to restriction under section 392 of the US Internal Revenue Code due to historical changes of ownership. Notwithstanding the availability of tax losses, Alternative Minimum Tax (“AMT”) was payable on the profits of our US subsidiaries arising in the year. For AMT purposes, the offset of prior year tax losses is restricted to 90% of current year taxable profits, with AMT chargeable on the remainder at a rate of 20%.

10. Earnings per Share

The calculation of basic loss per ordinary share is based on a profit of £152,000 (2009: loss of £1,494,000), and on 145,579,000 (2009: 145,579,000) ordinary shares, being the weighted average number of ordinary shares in issue during the year. The effect of all potential ordinary shares is anti-dilutive.

11. Intangible Assets

In accordance with IAS 38 Intangible Assets, certain development expenditure must be capitalised and amortised based on detailed technical criteria, rather than automatically charging such costs in the income statement as they arise. This has led to the capitalisation of £657,000 (2009: £945,000), and amortisation of £710,000 (2009: £642,000) during the year. A further £258,000 (2008: £327,000) of amortisation was incurred during the year relating to intangible assets acquired with Alignent. In addition, during 2009 and 2010 the recurring income from the acquired Alignent customer base reduced, due to a mix of factors including the conversion of certain rental licenses to perpetual, changes in rental levels, and cancellations. The overall reduction exceeded the rate of attrition of such recurring income estimated in the original valuation exercise, leading to impairments in the carrying value of the acquired Alignent intangible assets of £180,000 (2009: £180,000).

12. Cautionary Statement

Sopheon has made forward-looking statements in this press release, including statements about the market for and benefits of its products and services; financial results; product development plans; the potential benefits of business relationships with third parties and business strategies. These statements about future events are subject to risks and uncertainties that could cause Sopheon's actual results to differ materially from those that might be inferred from the forward-looking statements. Sopheon can make no assurance that any forward-looking statements will prove correct.