We meet innovation consultant Hannah Keartland, whose experience puts her in a unique position to answer one of the biggest questions for business leaders considering innovation.

Hannah initially trained as an accountant and worked in finance. “Finance has a role of mitigating risk”, she explains when we connect one morning.

Hannah understands why risk management is so important in business, and why it plays a big role in successful innovation. “I moved to project management, and then from that, I moved into innovation,” she says, adding, ”Innovation is about capitalising on opportunities rather than sorting out problems! I’ve seen it from both sides.”

Hannah has seen first-hand how friction can arise when a business that is used to being risk-averse wants to innovate.

Why is innovation seen as risky?

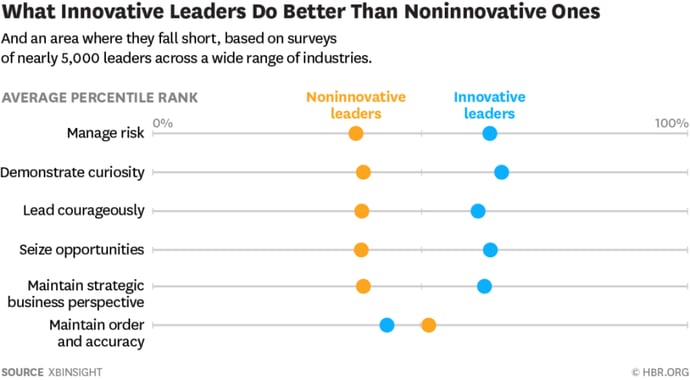

Fear of failure is one of the biggest blockers to innovation, and it can lead to a view that innovation is too risky. An article from Harvard Business Review from 2016 looked at the skills that innovative leaders have and compared them to non-innovative leaders. The article showed that innovative leaders are much better at managing risk than their non-innovative peers.

Hannah agrees. For her, innovation isn’t about being risky, it’s about managing innovation and taking calculated risks. “If you’re looking at it long-term, innovation is a mitigation,” she explains. “There are lots of external risks to any organisation, such as changing customer needs and expectations, competition, new technologies, and external shocks such as Covid and Brexit.

“Judgement isn’t in [the graph above], but I think it’s crucial in terms of innovation. It’s about right-sizing things. What’s the judgement here – are we able to take risks? If you’re developing the music system in a car you’ll have a very different risk tolerance than if you’re developing the braking system. Whereas a lot of organisations have a one size fits all approach, and that’s what causes issues for creativity and innovation because you slow everything down.

“You have to be constantly evolving to respond, you can’t be static – and that is innovation. In that sense it’s a mitigation. That said, it is riskier than your normal operation, where it’s much easier to do financial projections, look at trends and make reasonably sensible forecasts.

“Innovation is hard to put a number on – how much do you spend on it? How fast will it happen? Will it work? What will customers be willing to pay? In the early stages, you don’t know the answers, so it becomes about how you put frameworks around innovation to manage the risk.”

For the companies that are good at managing risk, innovation leads to growth, more customers, and better products. Yet focus on innovation is decreasing. The government’s UK Innovation Survey 2019 states that ‘in 2016-18, 38% of UK businesses were innovation active. This is a decrease compared to 49% in 2014-16 and is the lowest level since 37% in 2008-10.’

Since then, Covid-19 has led to many businesses doubling down on protecting their core activities, rather than trying to innovate their way out of the crisis (McKinsey & Company, Innovation in a crisis, June 2019). Despite the success of businesses such as Apple, Google, and Tesla, it’s clear that innovation is still seen as risky business. Hannah can understand why.

“There are three main reasons. The first is the idea of short-term versus long-term. Objectively you know that you need to innovate long-term, but you have a product right in front of you that will bring in income right now. Investing that money instead in innovation, which won’t bring in money right now and might not even work, is hard to do.”

“You can break it down into milestones to make it manageable, but then you also need to hold yourself accountable to make sure you take those small steps that involve spending money and diverting people to work on something that is unknown.”

This is tough to do for traditional leaders, who are used to running an organisation based on control, efficiency, compliance, and ensuring that you get the same output out all the time.

“Organisations nowadays are more like an organism,” Hannah says. “You can create an environment for it to do well, but it might not. Or it might do well but not do what you want it to do. So, the second reason innovation is seen as risky is because leading something that is more evolutionary and less like a machine requires different behaviour. It’s much more about judgement than control. You’re asking leaders to behave in a different way to the style they’ve always worked in, so it feels riskier because it’s uncomfortable for them.

“The third reason is the lack of certainty. It’s about creating conditions for it to thrive, versus having certainty over output.”

How do you manage risk in innovation?

So how do you create the conditions for innovation to thrive, while managing risk and not getting cold feet when things get tough? Hannah believes that you need to get really clear on what you’re trying to achieve and encourage a culture of experimentation within this framework.

“It is about developing a culture across the whole organisation that enables innovation. Everybody needs to shift their behaviour to enable innovation, and that definitely includes the senior leadership team. There are often some difficult conversations that need to be had, because you have to say ‘you need to change your leadership style’.

“If you really want to shift how your organisation operates and the culture you will need to change as well, because delivering innovation needs everybody collaborating on it, it can’t just be in a little siloed pocket.”

Hannah outlines three key behaviours organisations need to have to mitigate against risk:

- Being outcome-focused: Be really clear on where you’re trying to get to. Have a shared vision that everybody is moving towards, and objectives that you can hold yourself accountable against. There might be constraints, but it is about working together to overcome those constraints. This is vital so that the nervousness about taking short-term risks will be overridden by the knowledge that there is a bigger long-term risk of doing nothing.

- Exploration and experimentation: You’ve got to get comfortable with being uncomfortable, with ambiguity and with being curious. This is at odds with operational approaches which are about standardisation and squeezing out error. You have to allow in some error so that you can try out new ways of doing things.

- Collaboration and communication: Listen to other parts of the business and try to understand what matters to them. There are valid reasons for finance to follow procedure, and they are just as valid as the reasons for innovation. We need to listen to each other’s perspectives, but people also need to be confident saying ‘this is what I need, and this is why it’s important to me’.

“It’s not going to feel easy. It’s not going to feel comfortable. Uncertainty is far more stressful than knowing that a bad thing is going to happen. And in innovation you don’t know what’s going to happen, you just have to follow the signs that you should continue exploring something.

“But at least with this framework, a leader can say – I’m not going to tell you how to do it, I’m not going to tell you what to do, you can go away and experiment, but you need to prove XYZ and remove the riskiness around these key assumptions before we can release more funding. And we need to see you moving towards the vision we’ve set.

“I was just listening to the COO of Sweaty Betty who have a strategy to multiply their size by five in five years. You’re not going to do that by being incremental, you’re going to do that by being bold and moving into new markets.”

Implementing structure – the portfolio approach

'Structure' might not be the word that springs to mind when you think of innovation. Innovation requires experimentation and trying new things. Creating the conditions for this to work, however, involves implementing the right framework. This framework needs to give you clear visibility on whether your innovation programme is making progress. If it isn’t progressing, then you can pivot your strategy or stop these projects.

Leaders need to balance structure with the freedom for experimentation and not be prescriptive about the ‘how’ of how you get there. One framework that Hannah thinks works well in achieving this is the portfolio approach.

“The ideas that make it through tend to be the ideas that are much closer to what people are doing already. If you look at a portfolio approach, which is a great way of managing risk, the ideas are much closer to the core activities. They are the incremental ideas that are less radical and are more comfortable, and they deliver relatively quickly so they’re easier to justify and they get through.

“The stuff that is higher risk but potentially higher return – that’s what people want but they haven’t necessarily got the patience to stick with it, even if they can see things are heading in the right direction.

“You need to be really clear up front about what you actually want your innovation to achieve – have that honest conversation around ‘where do we want this to take us’. Then you can look at how you achieve that and ask, ‘how much do we need to do of just evolution of our existing products and services – incremental innovation – versus creating new products and services for our existing markets or taking our existing offering into new markets – adjacent innovation?’.

“And how much of the really transformative stuff do we need to do? For example, completely new products, new markets, new business models. Be really objective about that up front, and how you want that split to be across the portfolio, and then measure it and hold yourself to it.”

Hannah’s experience has shown her that people want innovation to be transformative, but it can become overwhelming without the right strategy. “Unless you’re measuring your portfolio against a strategy that says across all stages of the pipeline we want 70% in incremental, 20% in adjacent and 10% in transformative innovation, then the transformative stuff starts to get a bit scary because it’s taking a long time to deliver.

“That’s why Acclaim Ideas is a good solution. It gives you that visibility and you’ve got the data, which so many organisations just haven’t got the data on their portfolio to even have the conversations to say, well actually we’re killing all the transformative projects at stage-gate three, and why is that – is that because they’re not good enough, or is that because the decision-makers are getting cold feet, and if so what’s the intervention we then need to do?”